Five reasons to think about refinancing your home loan

Refinancing is getting a lot of attention right now, as speculation builds about the Reserve Bank increasing the cash rate in 2023 or even 2022.

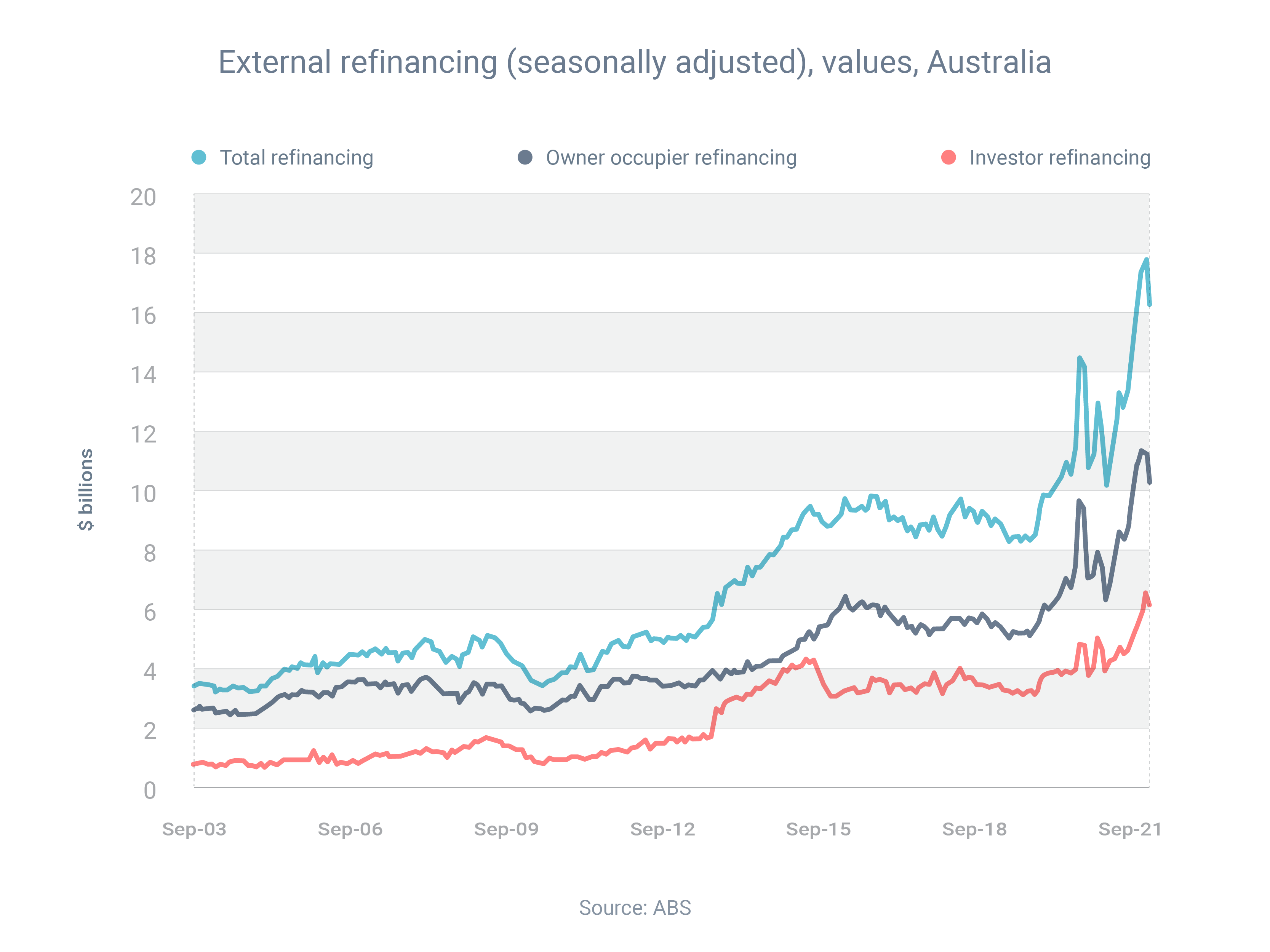

Australian Bureau of Statistics data shows that refinancing activity is at near-record levels.

In recent weeks, a host of lenders, including all of the big four banks, have increased their fixed rates, which might be causing some more borrowers to consider refinancing.

Also, some people might be thinking about refinancing to take advantage of equity they’ve built up in their home during the ongoing property boom.

So if you’re thinking about refinancing, you’re not alone. That said, you should refinance when it makes sense for your personal situation, not because other people are doing so or because the media is speculating about interest rate movements.

Depending on your scenario, refinancing might allow you to:

Reduce your interest rate

Switch your interest rate type (i.e. variable to fixed)

Pull out equity to fund the deposit on an investment property

Consolidate several higher-rate debts into a new lower-rate home loan

Get a loan with better features

Want to know if refinancing is right for you? I’ll be happy to talk you through the pros and cons.

Is refinancing right for you? Let’s find out.

Hit the button below to arrange a conversation with one of my loan specialists to find a deal that’s best for your situation.

We partner with over 50 lenders so you can find the perfect solution

Do you have questions about mortgages or loans?

Ask us in the comments below