Investors stepping up as first home buyers step down

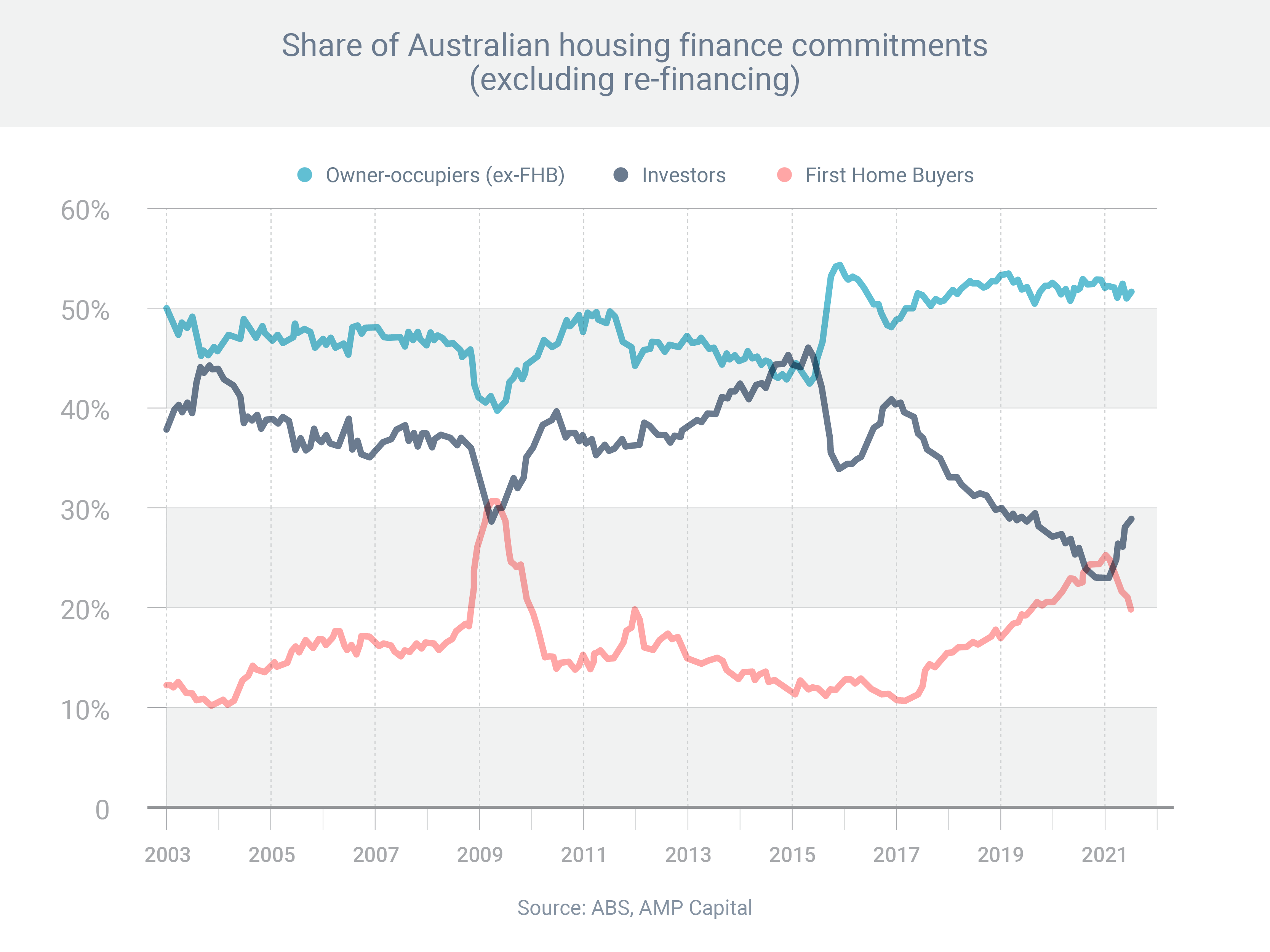

First home buyers have been drifting out of the market, while investors have been piling in, according to the most recent data from the Australian Bureau of Statistics.

June was the fifth consecutive month in which the number of first home buyer loans fell and in which the share of first home buyer loans (compared to the overall market) fell.

At the same time, June was the third consecutive month in which investors increased their market share.

Still, first home buyer activity is at historically high levels – the number of first home buyer loans in June was 47.1% higher than the year before.

But so is investor activity – which increased by 116.0% over the same period.

Whether you’re a first home buyer or an investor, the market is hot right now and competition for properties is fierce. So it’s important to organise pre-approval before you start house-hunting. That way, if you find a property you love, you’ll be able to make an offer immediately, which will improve your chances of success.

Call me to get pre-approved.

Hit the button below to arrange a conversation with one of my loan specialists to find a deal that’s best for your situation.

We partner with over 50 lenders so you can find the perfect solution

Share on: