Strong investor activity defies wider home loan trend

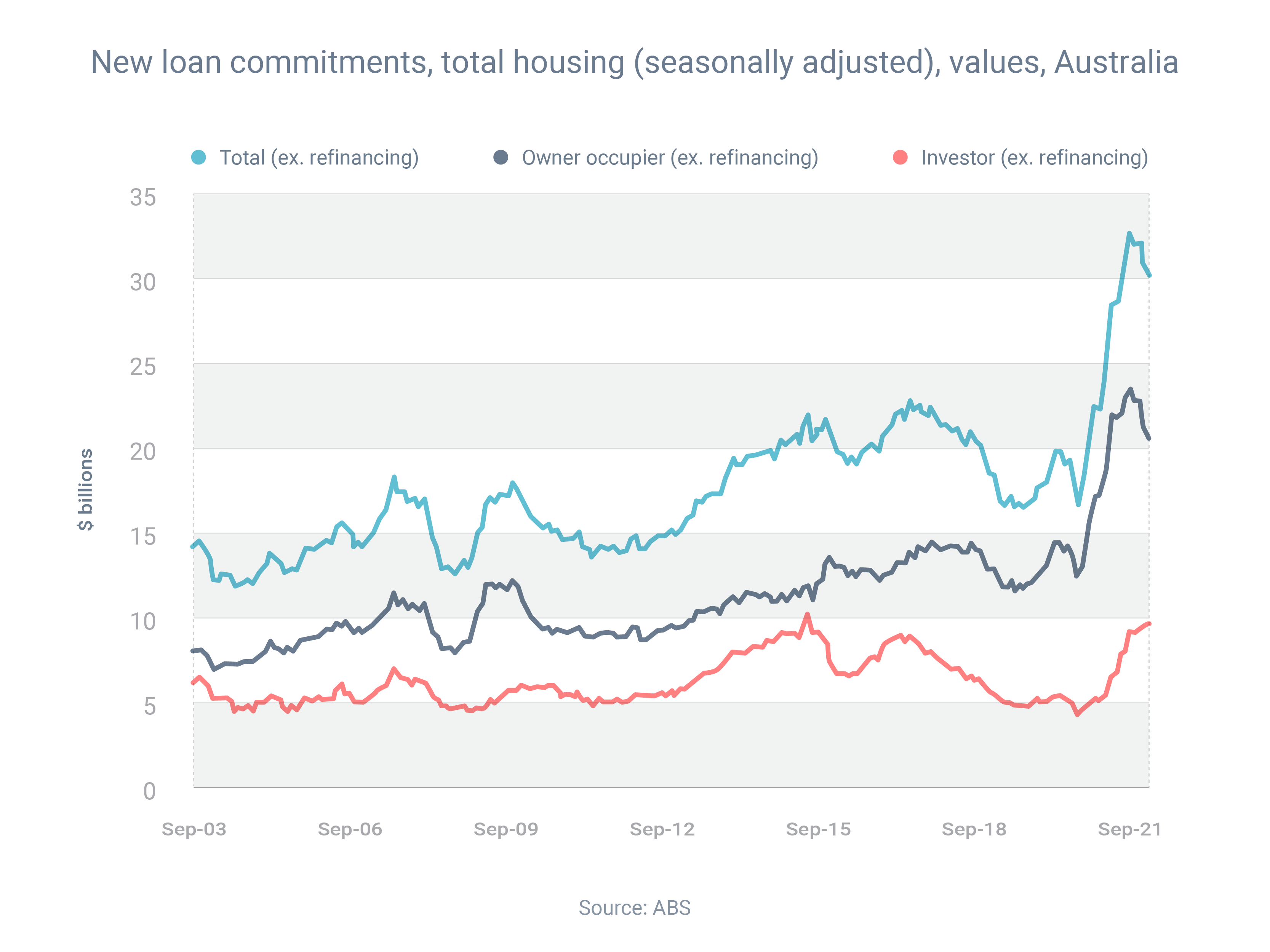

Investor borrowing has increased for 11 consecutive months, according to the most recent data from the Australian Bureau of Statistics.

During those 11 months, the value of loans that investors signed up for jumped from $5.1 billion in October 2020 to $9.6 billion in September 2021 – an increase of 87.5%.

The September result was also the second-largest month for investors in history.

Why are so many investors entering the market right now? Because, in many parts of the country, investors are enjoying a rare trifecta of rising prices, rising rents and falling vacancy rates.

Meanwhile, total home loan borrowing has been trending down since May, after previously reaching record-high levels.

Monthly home loan commitments fell from $32.6 billion in May to $30.3 billion in September, due to an ongoing decline in owner-occupier activity.

Whether you’re an investor or owner-occupier, it’s important to know your numbers and put a plan in place well before you start searching for a property. Feel free to contact me if you want to discuss your options.

Learn more about property investment

Hit the button below to arrange a conversation with one of my loan specialists to find a deal that’s best for your situation.

We partner with over 50 lenders so you can find the perfect solution

Share on: