Analysis finds property prices can go up even when rates are rising

For the past year, the cash rate has been at a record-low 0.10%, with the Reserve Bank using ultra-low interest rates as a way to stimulate the economy during the pandemic.

But what will happen if and when the Reserve Bank raises the cash rate? Will it lead to a downturn in the property market?

The answer is no, according to research by the Property Investment Professionals of Australia (PIPA), an association that represents buyer’s agents.

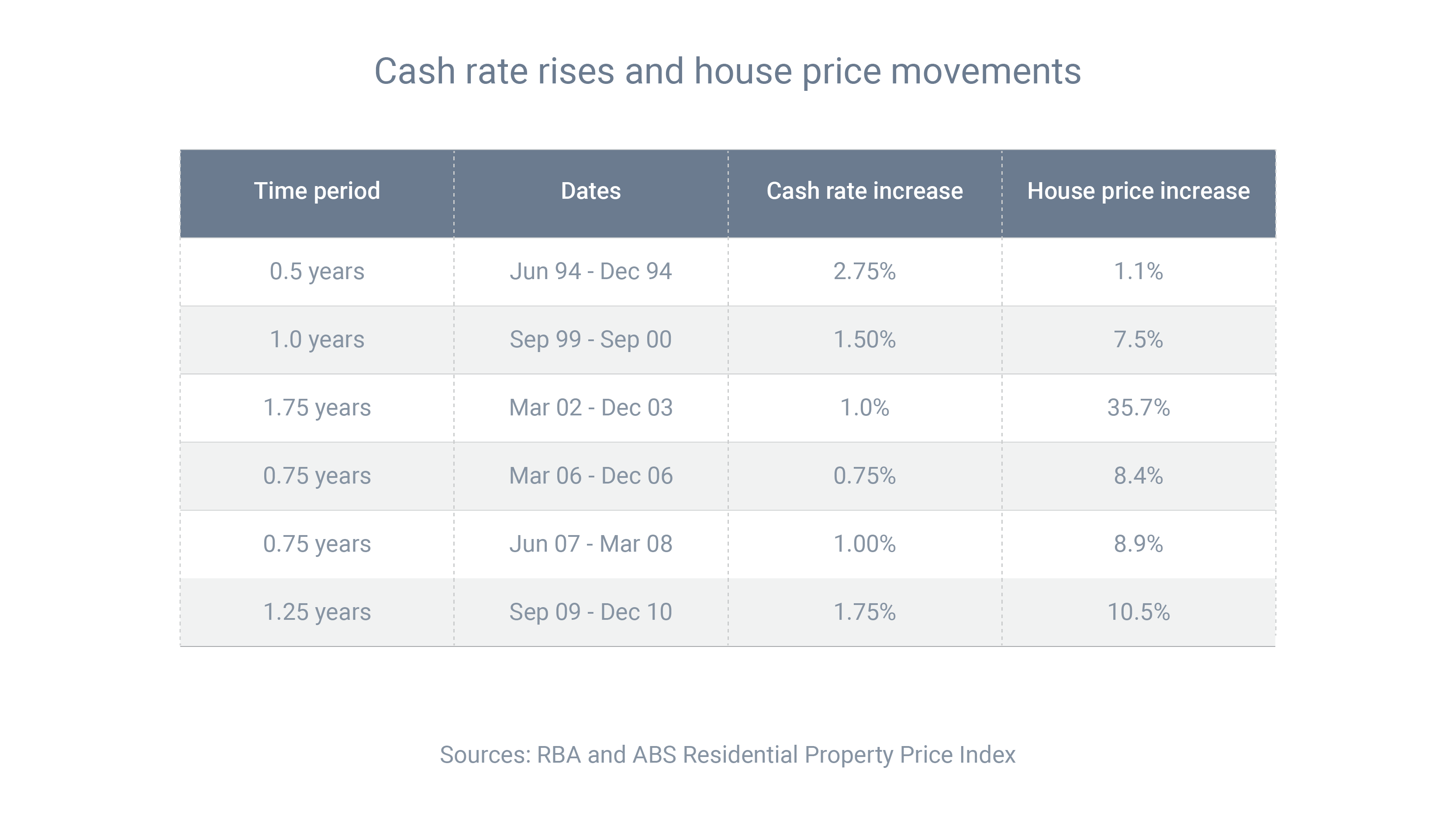

PIPA analysis of five periods of increasing cash rate movements since 1994 found that property prices continued to rise – sometimes significantly – even after rate rises of up 2.75 percentage points.

So if interest rate rises don’t lead to property downturns, what does?

PIPA says downturns occur because of some combination of reduced access to credit, falling affordability, worsening local economic conditions and declining consumer sentiment.

Need a loan? Let’s chat.

Hit the button below to arrange a conversation with one of my loan specialists to find a deal that’s best for your situation.

We partner with over 50 lenders so you can find the perfect solution

Share on: