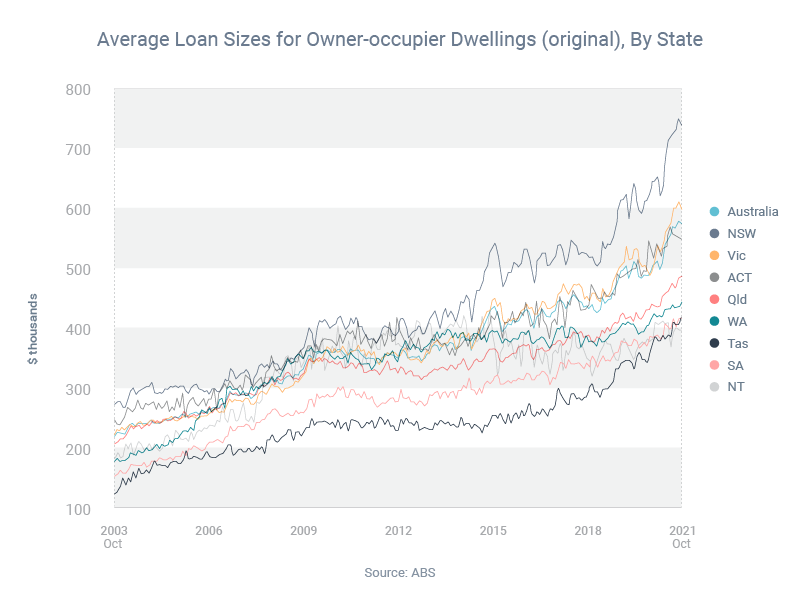

Australians taking out bigger loans in response to rising property prices

Over the year to October, the size of the average Australian home loan increased 16.4%, according to the latest data from the Australian Bureau of Statistics.

Loan sizes also increased in every individual state and territory, as the graph shows.

Naturally, the amount of money you borrow is very important. But so is the share of money you borrow compared to the value of the property you purchase.

This is known as your loan-to-value ratio (LVR). For example, if you borrowed $800,000 to buy a $1 million property, your LVR would be 80%.

The lower your LVR, the more likely lenders will offer you lower interest rates and special deals. Conversely, if your LVR is above 80%, you will probably have to pay lender’s mortgage insurance (LMI), an insurance policy to protect the lender in case the borrower defaults.

If you’re planning to buy in 2022, it’s important you think about:

- What your LVR is likely to be

- Whether you can aim for a lower LVR to access lower interest rates

- Whether you’re willing to pay LMI to enter the market early

The key is to be prepared and to crunch the numbers. I can help you with both tasks.

Need mortgage advice? I can help.

Hit the button below to arrange a conversation with one of my loan specialists to find a deal that’s best for your situation.

We partner with over 50 lenders so you can find the perfect solution

Share on: