How to overcome the deposit barrier

Despite the recent housing downturn, property prices are higher in most parts of the country than before the pandemic. As a result, deposit requirements are higher.

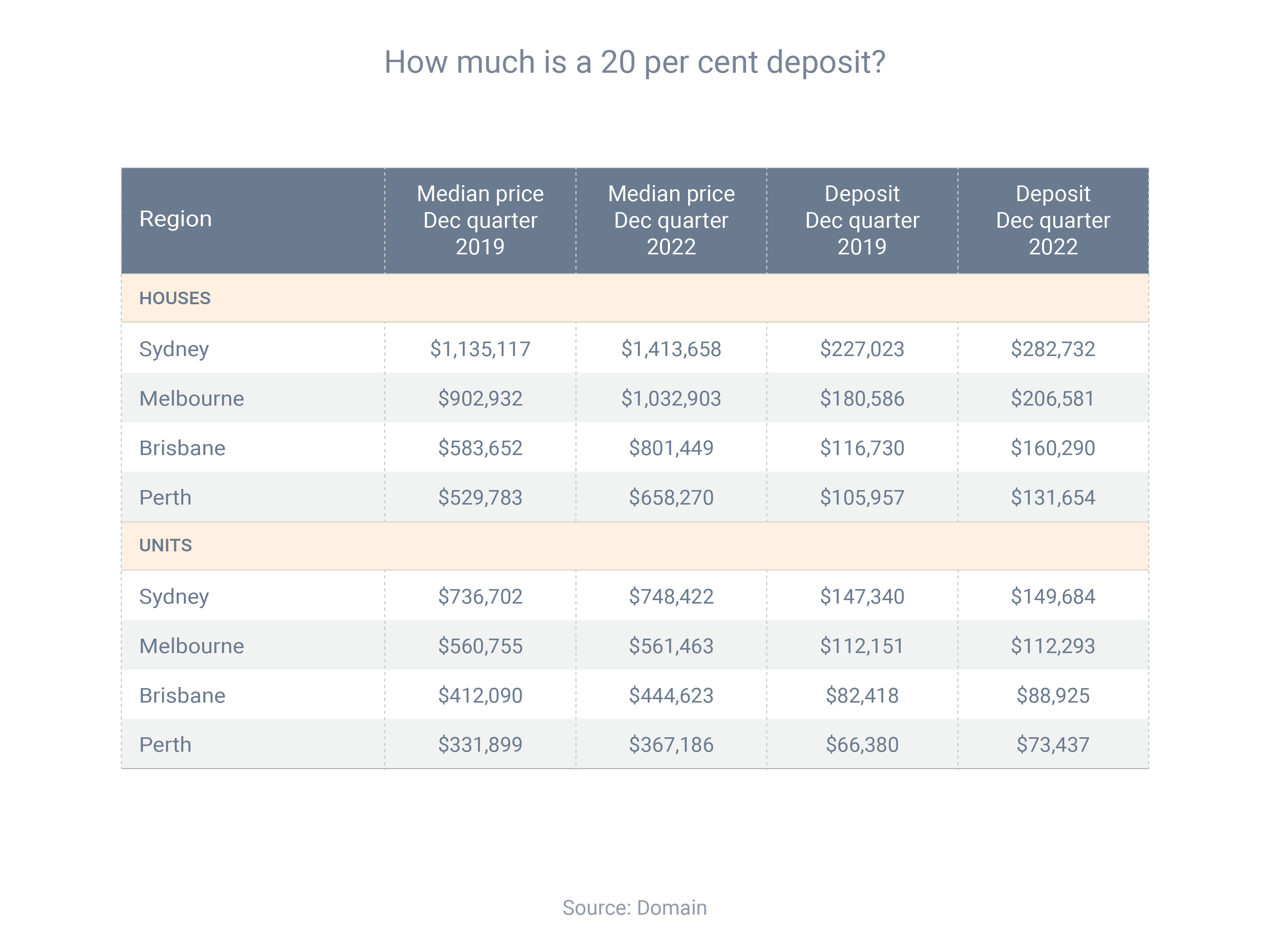

Domain compared property prices in the December quarters of 2019 and 2022, and found that buyers needed tens of thousands of dollars more today if they wanted to buy a house and put down a 20% deposit.

The increase in 20% house deposits for our four biggest cities was:

- Sydney $55,709 increase between 2019 and 2022

- Melbourne $25,995

- Brisbane $43,560

- Perth $25,697

While the deposit barrier is high, it’s not insurmountable.

As an expert mortgage broker, I can potentially help you enter the market with a low-deposit loan. Generally, if your deposit is lower than 20%, you will need to pay lender’s mortgage insurance (which can be added to your loan). While it’s never nice to pay an added fee, it can be money well spent if it lets you buy a property several years ahead of schedule.

Get strategic mortgage help.

Hit the button below to arrange a conversation with one of my loan specialists to find a deal that’s best for your situation.

We partner with over 50 lenders so you can find the perfect solution

Share on: