Why interest rates have climbed

While interest rates have increased significantly over the past 18 months, this increase, thankfully, has been less than one might have expected, due to competition, according to the Reserve Bank.

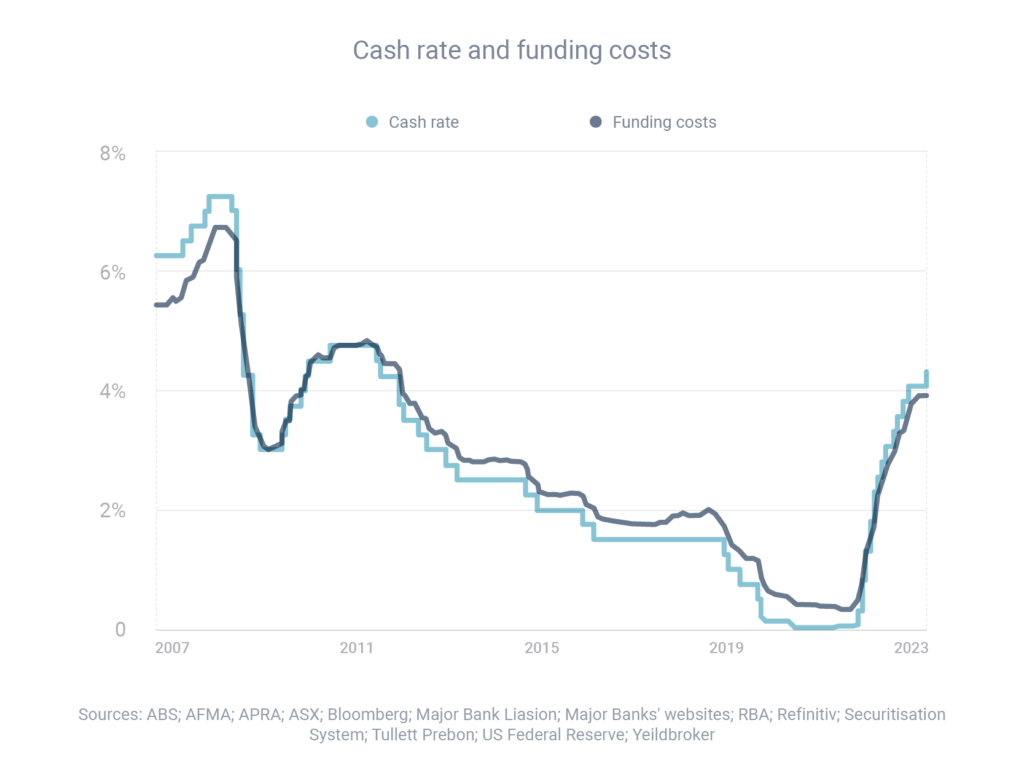

Between April 2022 and September 2023, the cash rate increased by 4.00 percentage points. However, banks increased their variable rates by, on average, only 3.32 points for owner-occupiers and 3.28 points for investors. This was due, in part, to “the effect of competition between lenders on variable-rate housing loans”.

Meanwhile, banks’ funding costs increased further between the June and September quarters, which is likely to lead to higher interest rates and more pain for households.

The increase in funding costs came “as banks replaced maturing bonds issued at much lower rates and average deposit rates increased”.

Banks generally ‘buy’ funding on the wholesale market, add a margin and then on-sell this money to borrowers in the form of home loans (and other loans). So when banks’ funding costs increase, they generally have little option but to increase rates as well.

Want to compare interest rates? Let’s talk

Hit the button below to arrange a conversation with one of my loan specialists to find a deal that’s best for your situation.

We partner with over 50 lenders so you can find the perfect solution

Do you have questions about mortgages or loans?

Ask us in the comments below