First home buyer loans rise 12.9%

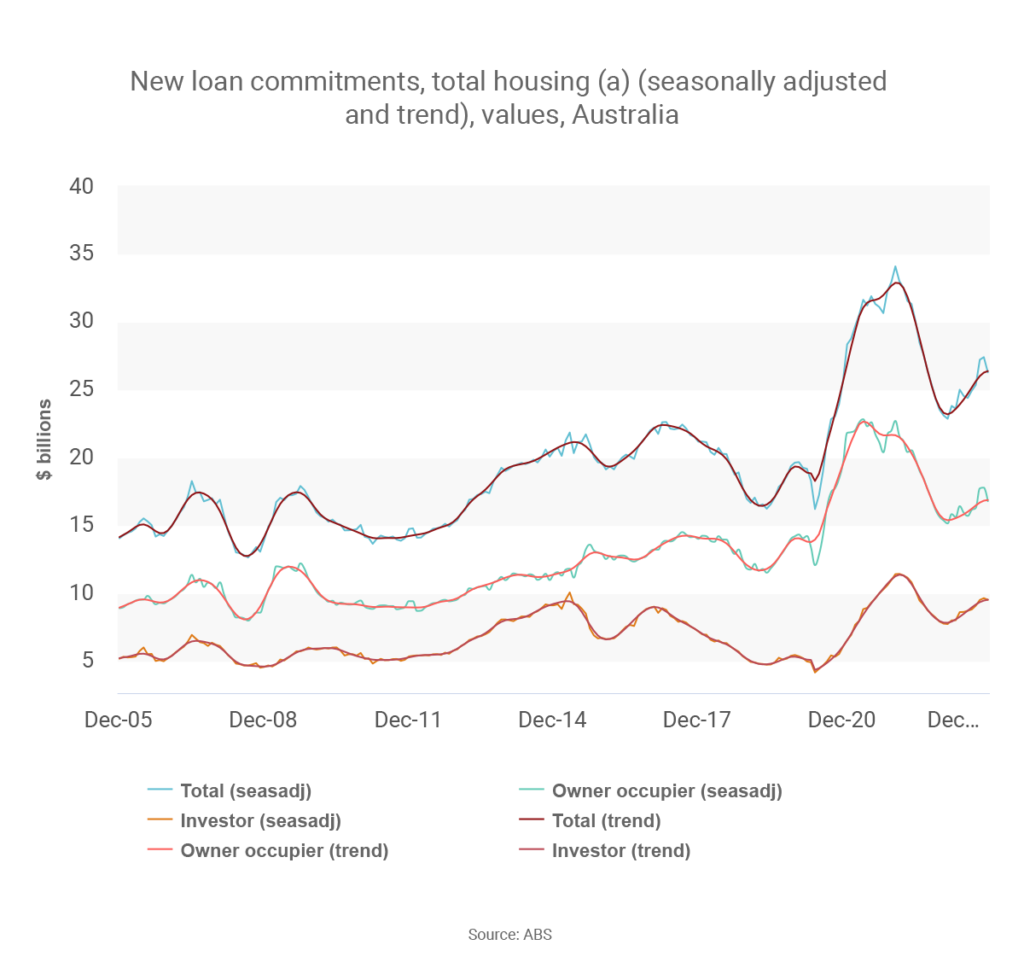

There’s been a significant increase in first home buyer activity over the past year, based on the latest data from the Australian Bureau of Statistics.

There were a total of 9,491 owner-occupier first home buyer mortgages issued across Australia in December 2023, which was 12.9% higher than the year before.

First home buyer activity rose in six of the eight states and territories, with Queensland and Tasmania being the exceptions to the rule.

While it can be challenging to buy your first home, this data shows it’s not impossible. Here are four tips to get on the property ladder:

- Look for ways to decrease your spending

- Check whether you’re eligible for the First Home Guarantee or Regional First Home Buyer Guarantee

- Consider asking your parents or another relative to guarantee your home loan (so you can drastically reduce or even eliminate your deposit requirement)

- Contact me, so I can explain your options and coach you through the process

Get in touch if you need a home loan

Hit the button below to arrange a conversation with one of my loan specialists to find a deal that’s best for your situation.

We partner with over 50 lenders so you can find the perfect solution

Do you have questions about mortgages or loans?

Ask us in the comments below