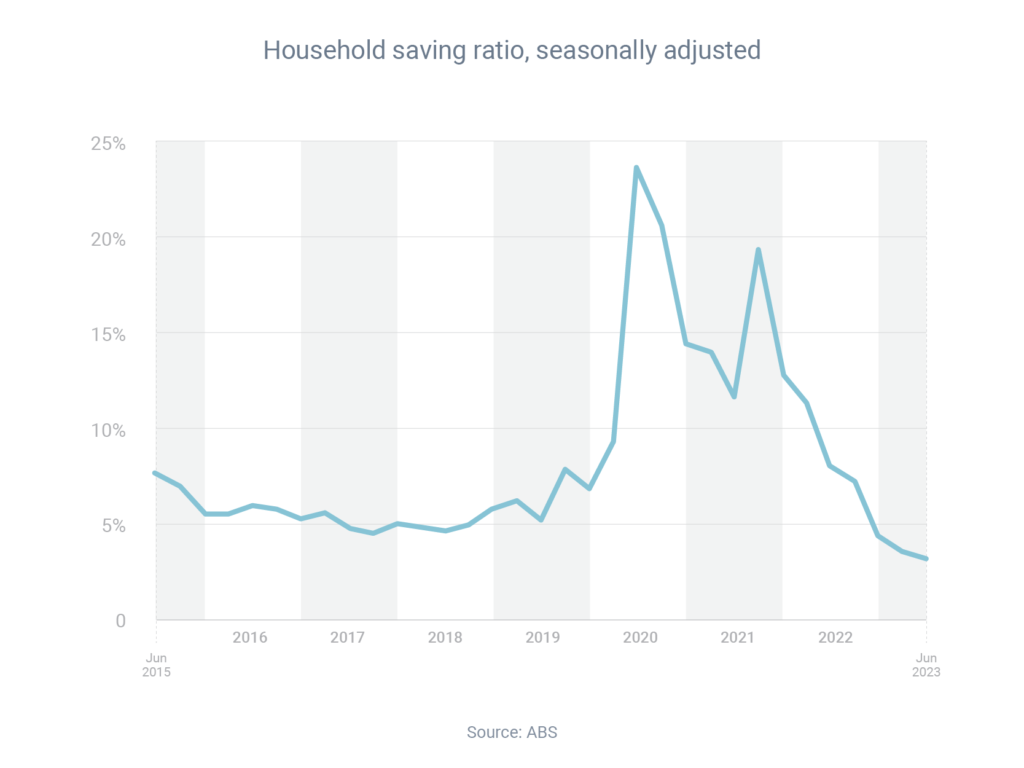

Australians now saving just 3.2% of their income

Household savings have now fallen for seven consecutive quarters, suggesting some consumers are finding it harder to save for a home deposit due to rising cost of living.

The latest Australian Bureau of Statistics data show that the share of income that households save fell significantly between the quarters of September 2021 and June 2023:

- Sep-21: 19.3%

- Dec-21: 12.9%

- Mar-22: 11.3%

- Jun-22: 8.1%

- Sep-22: 7.2%

- Dec-22: 4.4%

- Mar-23: 3.6%

- Jun-23: 3.2%

This decline in saving has been partly caused by the pandemic: people spent less during lockdown, because they were stuck at home, and then engaged in ‘revenge spending’ after being released. But it’s also been caused by the high inflation we’ve experienced during that time, which has forced consumers to spend more money just to buy the same items.

If you have a mortgage and you’re struggling to make repayments, get in touch so we can speak to your lender. Lenders tend to be more flexible with borrowers who get on the front foot about any financial problems they may be experiencing.

Want to compare interest rates? Let’s talk

Hit the button below to arrange a conversation with one of my loan specialists to find a deal that’s best for your situation.

We partner with over 50 lenders so you can find the perfect solution

Share on: