Australia’s mortgage market has been getting safer

Banks have raised their lending standards over the past decade or so, by reducing their volume of low-deposit and interest-only loans.

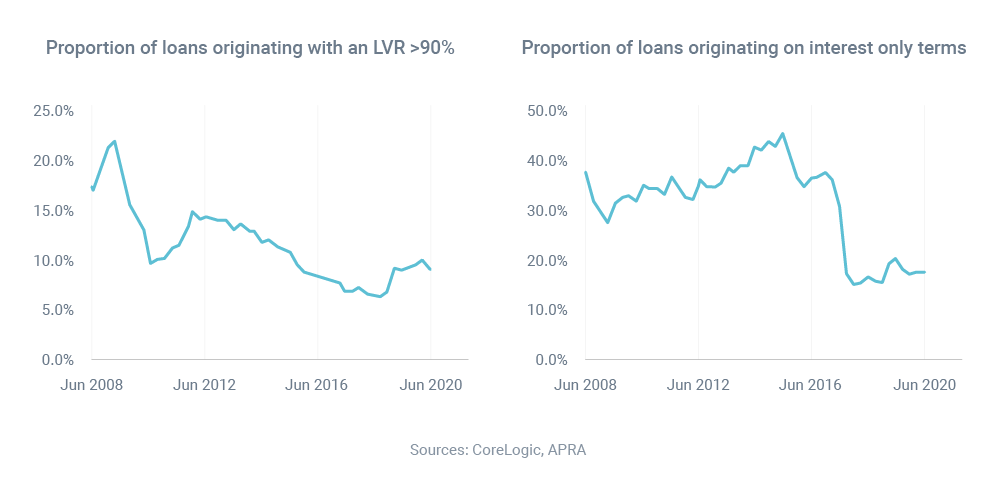

The share of home loans with a loan-to-value ratio (LVR) of 90% or more (i.e. a deposit of 10% or less) fell from 22% in 2009 to 9% in June 2020, according to data from APRA, Australia’s mortgage regulator.

Meanwhile, the share of interest-only loans was 46% in 2015, but averaged only 17% of new lending from mid-2017 to mid-2020.

That doesn’t mean it’s no longer possible to buy a home with a 10% deposit or take out an interest-only loan – it is. There are still lots of options available for that type of borrower.

Needing a great deal?

Hit the button below to arrange a conversation with one of my loan specialists to find a deal that’s best for your situation.

We partner with over 50 lenders so you can find the perfect solution

Share on: