Be careful with ‘buy-now-pay-later’ this holiday season

The use of buy-now-pay-later services is exploding – and causing some people financial harm.

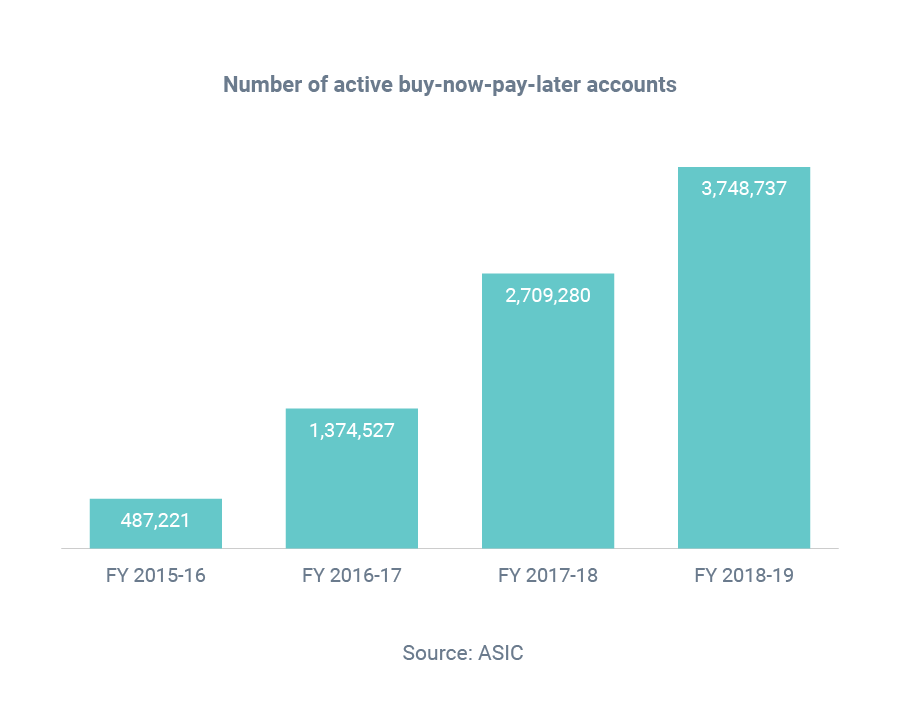

The number of active buy-now-pay-later (BNPL) accounts increased 38% and transactions jumped 90% between the 2017-18 and 2018-19 financial years, according to a report from ASIC.

ASIC found that 21% of users who were surveyed had missed a payment in the previous 12 months.

Another negative impact is the red flags it can raise during a home loan application. Banks and lenders that see BNPL on your banking statements get nervous about your savings and spending habits.

Simply put, lenders might question your ability to budget and live within your means.

All BNPL providers are not looked at the same when you apply for a home loan. Some have higher risk associated with the way they lend money and it can lead to more difficulty with a home loan application.

If you’re going to use BNPL, treat it as a short-term loan that you pay back as quickly as possible.

Needing a great deal?

Hit the button below to arrange a conversation with one of my loan specialists to find a deal that’s best for your situation.

We partner with over 50 lenders so you can find the perfect solution

Share on: