Big boost for first home buyers

The 5% Deposit Scheme has quietly become one of the most powerful tools first home buyers have – and the latest expansion is a genuine game-changer.

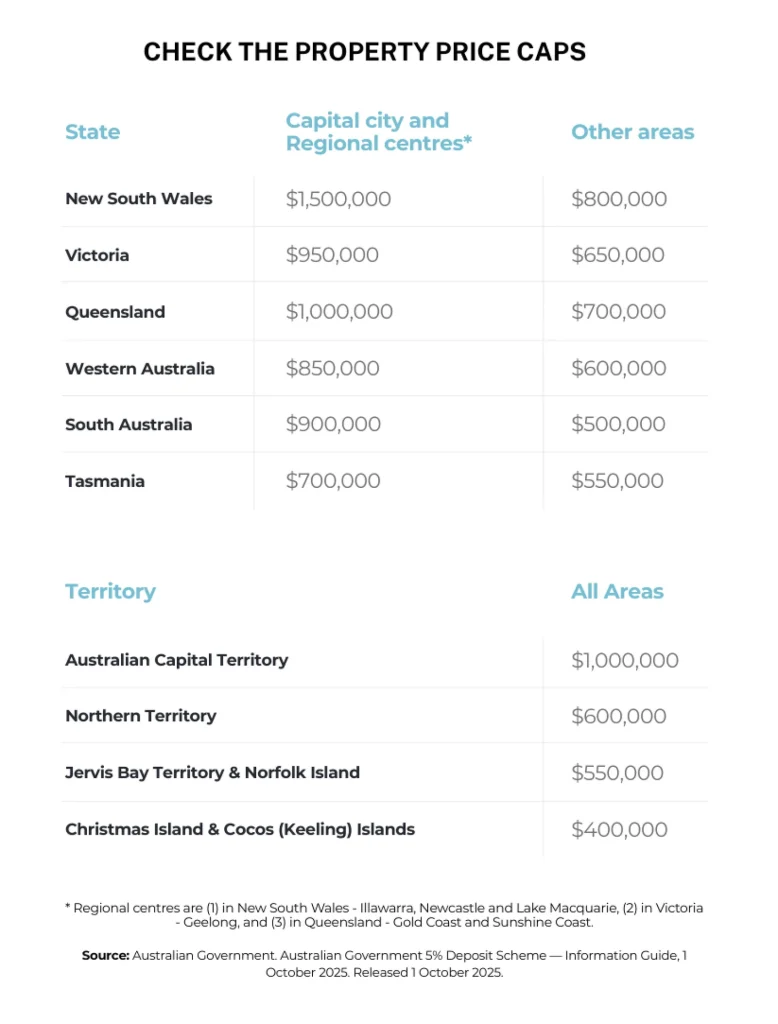

From 1 October, the scheme now offers unlimited places and no longer has income caps. Eligible buyers can purchase with just a 5% deposit and avoid the large cost of lenders’ mortgage insurance (LMI), provided the property sits under your location’s price cap (from $500,000 in regional South Australia up to $1.5 million in Sydney).

The interesting shift isn’t just the expanded access – it’s how it’s expected to reshape competition. Without income caps, higher-earning couples who were previously excluded can now enter popular markets, which may push more demand into price ranges just under the caps.

What this means in practice

- More buyers competing for townhouses and units in suburbs close to cap thresholds.

- Fast-moving markets, as buyers with small deposits can now act sooner.

- Larger borrowing amounts, because deposits are smaller and LMI isn’t required.

Think before using the scheme

Think before using the scheme

Even though the deposit hurdle is lower, your long-term repayment comfort still matters. A higher loan balance means repayments need to fit safely within your budget and buffers.

If you want to check whether you’re eligible – or see what your repayments might look like under the scheme – I can run the numbers for you.

Check your 5% deposit options

Hit the button below to arrange a conversation with one of my loan specialists to find a deal that’s best for your situation.

We partner with over 50 lenders so you can find the perfect solution

Share on: