First home buyers now need less time to save a deposit

Over the past year, it’s become significantly easier for first home buyers to save a 20% house deposit, according to new research from Domain.

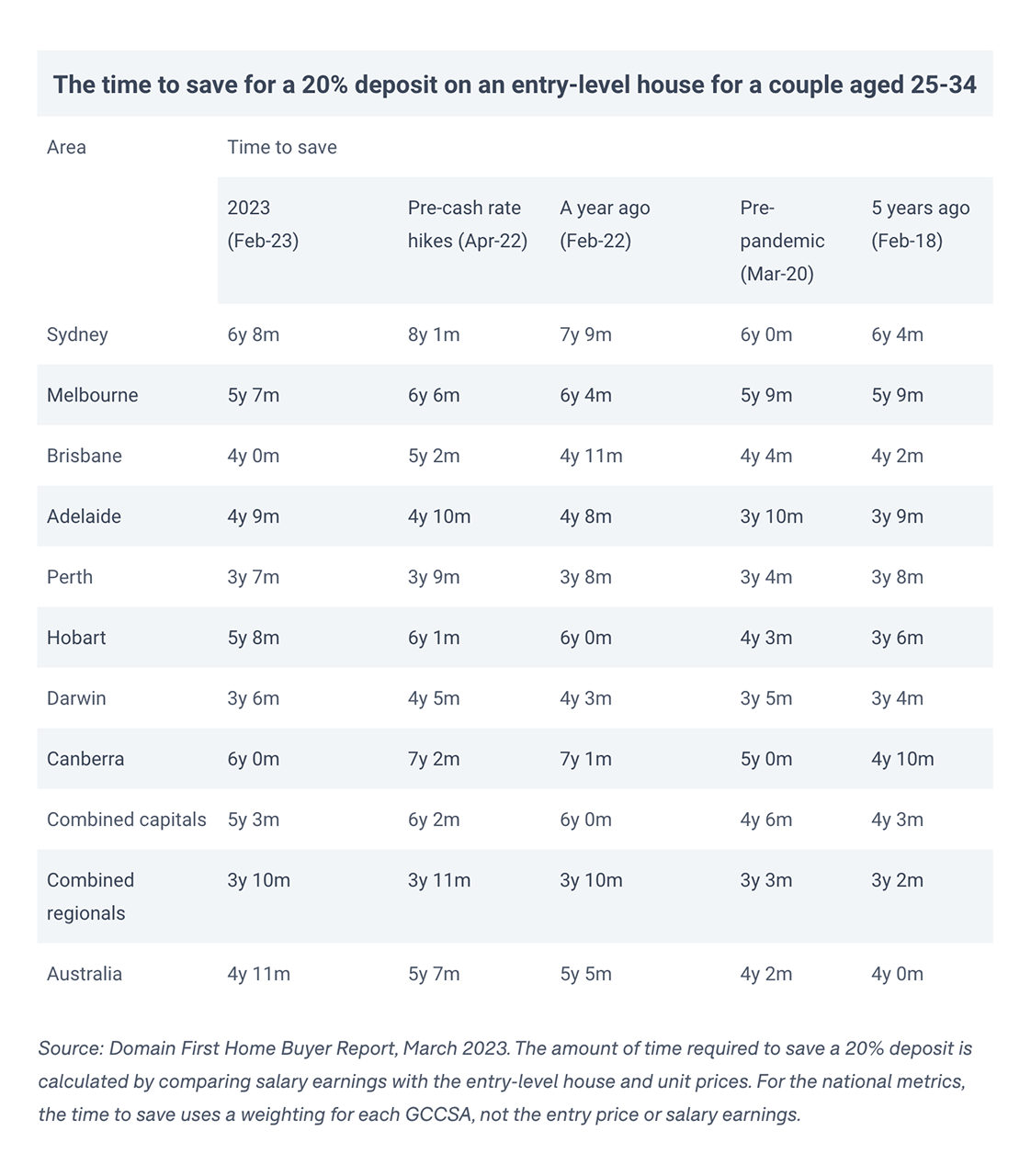

In February 2022, first home buyers needed an average of 5 years 5 months to save a 20% house deposit. By February 2023, that had fallen to 4 years 11 months.

It’s also become easier for first home buyers to save a 20% unit deposit, with the average time falling from 3 years 9 months to 3 years 7 months.

Domain calculated the average income and purchase price of first home buyers by assuming they were a couple aged between 25-34 years and were purchasing an entry-level property.

The reason first home buyers now need less time to save a deposit is because property prices have fallen over the past year, which means the deposit requirement has also fallen.

I love helping first home buyers enter the market. If you want to buy your first home (or your children do), reach out today so I can explain your options.

See how much you can borrow now.

Hit the button below to arrange a conversation with one of my loan specialists to find a deal that’s best for your situation.

We partner with over 50 lenders so you can find the perfect solution

Share on: