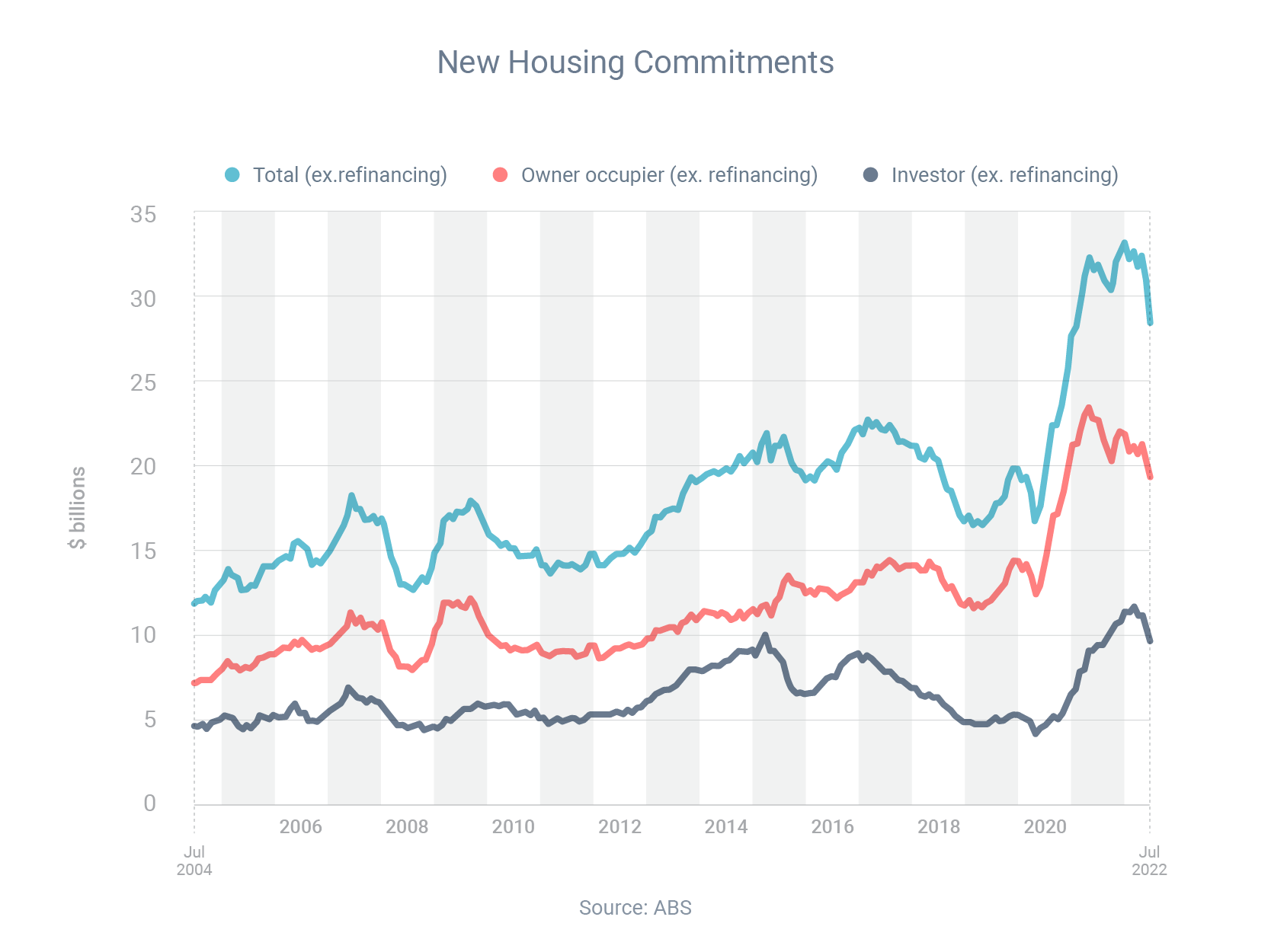

Home loan activity falls but remains well above long-term average

There are still a lot of active buyers in the property market, judging by the latest home loans data from the Australian Bureau of Statistics.

Borrowers signed up for $28.4 billion of new home loans in July. That was 11.3% lower than the previous year but 47.3% higher than the average over the previous 15 years.

So while conditions are much more buyer-friendly than they were during the recent property boom, there’s still quite a bit of buyer competition, especially for quality homes.

Meanwhile, refinancing activity is close to record-high levels.

Borrowers refinanced $17.9 billion of home loans through new lenders in July – which was not only 7.6% higher than the year before but also the second-biggest refinancing month in history.

With interest rates rising, many people realise how important it is to be on a lower-rate loan, so they’re shopping around.

I’ve helped many people refinance, and I can help you too. Get in touch so we can discuss your options.

Reach out if you want to refinance.

Hit the button below to arrange a conversation with one of my loan specialists to find a deal that’s best for your situation.

We partner with over 50 lenders so you can find the perfect solution

Share on: