Buying a home is a big step, and understanding your mortgage is important. One of the best tools to help you is a home loan repayment calculator. This tool can show you how much you will pay each month for repayments on 300k mortgage. Knowing these numbers can help you plan your budget and make smart financial choices.

In this comprehensive guide, we will explain how to use a home loan repayment calculator. We will also discuss different factors that affect your repayments on a 300k mortgage, such as interest rates and loan terms. By the end of this guide, you will have a clear understanding of what to expect and how to manage your mortgage payments effectively.

How Much Deposit Do You Need For A $300,000 Mortgage?

To buy a home worth $300,000, the amount you need for a down payment can vary. If you choose a traditional option of 20%, you would need to pay $60,000 upfront. This larger down payment can help you avoid private mortgage insurance (PMI) and may lead to better interest rates. However, there are also options for lower down payments. For example, with an FHA loan, you can put down as little as 3.5%, which would be $10,500 for a $300,000 house. Some conventional loans allow for even lower down payments of 3%, meaning you would need only $9,000 to start.

When considering how much deposit you need, it’s also essential to think about your monthly repayments on a $300k mortgage. If you put down 20%, your monthly payments will be lower compared to a smaller down payment. For instance, with a 20% down payment and a 6% interest rate, your monthly payment could be around $1,816. If you only put down 5%, your monthly payment might rise to approximately $2,440, including PMI. This shows how a larger deposit can significantly affect your monthly financial commitment.

In addition to the down payment, you should consider other costs associated with buying a home. These include property taxes, homeowners insurance, and maintenance fees. All these expenses can add up, so it’s wise to budget for them when planning to purchase a $300,000 home. Understanding these factors will help you make informed decisions about how much you can afford to pay upfront and what your ongoing costs will be.

How to Use A Home Loan Repayment Calculator

A home loan repayment calculator is a useful tool that helps you estimate your monthly payments and the total interest you’ll pay over the life of your loan. Here’s how to use one:

When using a home loan repayment calculator, you’ll need to enter your loan details, such as the loan amount, interest rate, and loan term. For example, if you have a 300k mortgage, you would enter “300,000” as the loan amount.

The loan term is the number of years you have to repay the loan. Most home loans have terms of 15 or 30 years. The longer the term, the lower your monthly payments will be, but you’ll pay more interest over the life of the loan.

Home loan repayment calculators typically offer different loan types, such as fixed-rate or adjustable-rate mortgages. A fixed-rate mortgage has the same interest rate for the entire loan term, while an adjustable-rate mortgage has an interest rate that can change over time.

Once you’ve entered all your loan details, the calculator will show you your estimated monthly payments and the total interest you’ll pay over the life of the loan. For a 300k mortgage, your monthly payments and total interest will depend on your interest rate and loan term.

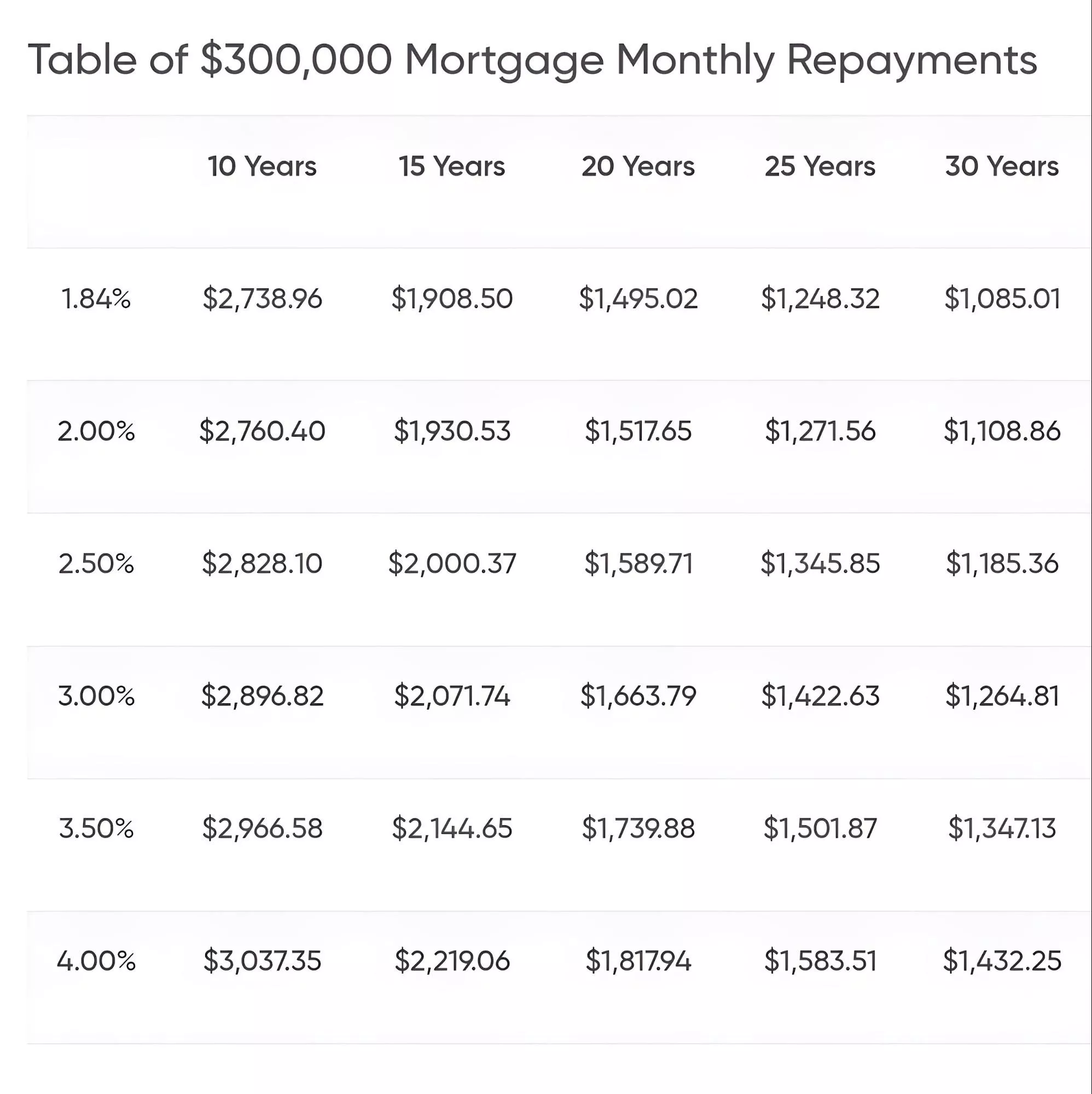

Table of Monthly Repayments on 300k Mortgage

The Importance of Early Repayments on 300k Mortgage

When you take out a mortgage, you borrow a large amount of money to buy a home. For example, if you have a 300k mortgage, you will pay back this amount over many years. Making early repayments on a 300k mortgage can help you save a lot of money. Each time you pay extra, you reduce the total amount you owe. This means you will pay less interest over time, which can save you thousands of dollars.

Early repayments on a 300k mortgage also help you pay off your loan faster. If you usually pay a set amount each month, adding extra money can shorten the loan term. For instance, if your mortgage is for 30 years, paying extra each month might allow you to pay it off in 25 years instead. This not only gives you peace of mind but also allows you to own your home outright sooner.

Another benefit of early repayments on a 300k mortgage is that it can improve your financial situation. With a smaller mortgage balance, you may have more money available for other expenses or investments. This can lead to less stress and more freedom in your budget. Overall, making early repayments is a smart choice that can lead to a brighter financial future.

Contact A Mortgage Broker to Help You Make Repayments on 300k Mortgage

When it comes to getting a mortgage for £300,000, it’s crucial to work with a professional mortgage broker. A broker can help you navigate the complex world of mortgages and ensure you get the best deal possible for your repayments on a 300k mortgage.

At Freshwater Financial Services, we are the best mortgage brokers you can work with to get the most competitive rates for your £300,000 mortgage. Our team of experts has extensive knowledge of the mortgage market and can help you find the right lender and product for your specific needs. We’ll take the time to understand your financial situation and goals, and then use our extensive network of lenders to find you the best possible deal.

One of the main benefits of working with a mortgage broker like Freshwater Financial Services is that we have access to a wide range of lenders and products that may not be available directly to the public. This means that we can often find you a better rate or more favourable terms than you would be able to get on your own. Additionally, we can help you navigate the application process and ensure that everything is completed correctly, which can save you time and stress.

Another advantage of working with a mortgage broker is that we can provide you with personalised advice and support throughout the entire process. We’ll be there to answer any questions you may have and to help you make informed decisions about your mortgage. Whether you’re a first-time buyer or an experienced homeowner, we can provide you with the guidance and support you need to make the best possible decision for your repayments on 300k mortgage.

FAQs

A home loan repayment calculator is a tool that helps you estimate your mortgage repayments based on the loan amount, interest rate, and repayment type. By entering details like the current interest rate and loan terms, you can see how much your principal and interest repayments will be. This calculator allows you to compare repayments for different home loan products, such as fixed rate home loans and variable home loans.

To use a loan calculator, simply input your loan amount, current interest rate, and repayment frequency. The calculator will then provide you with an estimated mortgage repayment amount, showing both minimum repayment and total interest charge over the loan term. You can also adjust for extra repayments to see how they could affect your loan balance and repayment amount.

Several factors affect your home loan repayment amount, including the loan product type (fixed rate or variable rate home loan), the current interest rate, and the repayment frequency. Additionally, terms and conditions of your home loan can influence how repayments are calculated. By using a mortgage repayment calculator, you can see how changes in these factors impact your estimated home loan repayments.

Yes, many home loan products allow for extra repayments. Making additional repayments can help reduce your loan balance and lower the total interest charge over time. Using a mortgage repayment calculator, you can estimate how these extra repayments could change your repayment amount and the overall cost of your new home loan.

Fixed rate home loans have an interest rate that stays the same for a set period, providing stable mortgage monthly repayments. In contrast, variable rate home loans have an interest rate that can change, affecting your repayment amount. When using a loan calculator, you can compare home loan rates for both types to see which option might be better for your financial situation.

You can compare different home loan products by using a home loan repayment calculator. By entering details for each loan product, such as interest rates and repayment types, you can see how the repayments are calculated for each option. This allows you to make an informed decision based on estimated home loan repayments and the overall cost of each loan.

When choosing a repayment frequency, consider your income schedule and budget. You can select weekly, bi-weekly, or monthly repayments, which can affect your total interest charge and loan balance over time. Using a mortgage repayment calculator can help you estimate how different repayment frequencies impact your mortgage monthly repayments.

To find the best home loan rates, start by comparing offers from various lenders and using a loan calculator to estimate your mortgage repayments for each option. Look for home loan products with favourable terms and conditions, and consider consulting a mortgage expert for additional insights. A mortgage repayment calculator can help you evaluate the total cost of each loan, including interest-only repayments and principal and interest repayments.

Get in touch if you need a construction loan.

Hit the button below to arrange a conversation with one of my loan specialists to find a deal that’s best for your situation.

We partner with over 50 lenders so you can find the perfect solution

Share on: