Home loans demand soars thanks to record-low interest rates

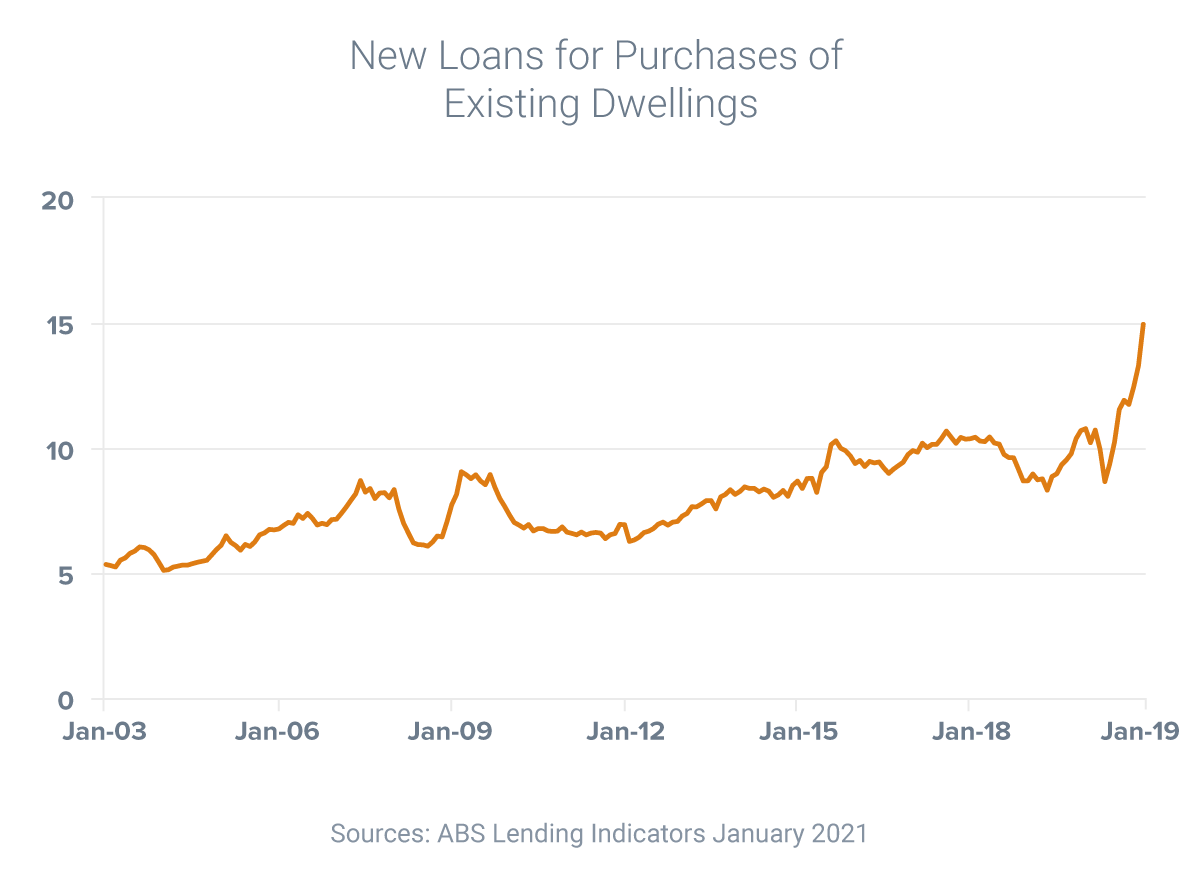

Australians took out a record amount of mortgages in January, according to the most recent data from the Australian Bureau of Statistics.

Home loan commitments hit $28.8 billion – a staggering 44.3% increase on the year before:

- Owner-occupier loans = $22.1 billion (up 52.3%)

- Investment loans = $6.6 billion (up 22.7%)

Demand is being driven by record-low interest rates, rising property prices and government incentives.

3 home loan tips for 2021

Here are three things to do if you want to give yourself the best chance of locking in a low rate and buying the home of your dreams:

- Speak to a broker – lenders are competing hard for business and are offering special deals that many consumers don’t know about

- Get your finance organised early – some lenders are taking longer to process loans and you may need to wait longer than you’re used to

- Impress lenders with a clean credit profile – pay bills on time, reduce your credit card limit and minimise the number of credit applications you make

Need a home loan?

Hit the button below to arrange a conversation with one of my loan specialists to find a deal that’s best for your situation.

We partner with over 50 lenders so you can find the perfect solution

Share on: