How to escape the increasingly expensive rental market

With rents climbing steeply in many parts of the country, 2022 might be the ideal time for younger Australians to enter the market.

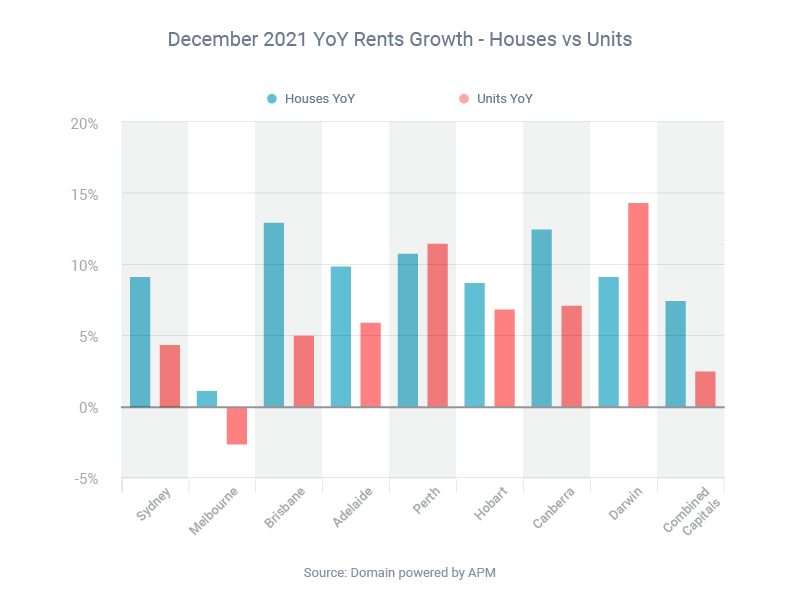

The average rent paid by a tenant living in a capital city was 7.4% higher in the December quarter of 2021 than the same quarter of 2020, according to Domain.

So if you’re a first home buyer, you might be wondering – what can you do to save a deposit? Options include:

- Increase your income – e.g. get a second job, do more shifts, start a side hustle

- Reduce your expenses – e.g. move to a cheaper rental property, cut back on home delivery, buy less ‘stuff’

- Reduce your deposit – e.g. opt for a low-deposit loan, a family guarantee loan or a spot in the First Home Loan Deposit Scheme

Don’t worry if any of this sounds confusing – I can explain your options to you in plain English. When you’re ready to talk, I’ll be happy to guide you through the process.

Call me if you’re a first home buyer.

Hit the button below to arrange a conversation with one of my loan specialists to find a deal that’s best for your situation.

We partner with over 50 lenders so you can find the perfect solution

Share on:

Share on: