Inflation data boosts prospects of further RBA rate cuts

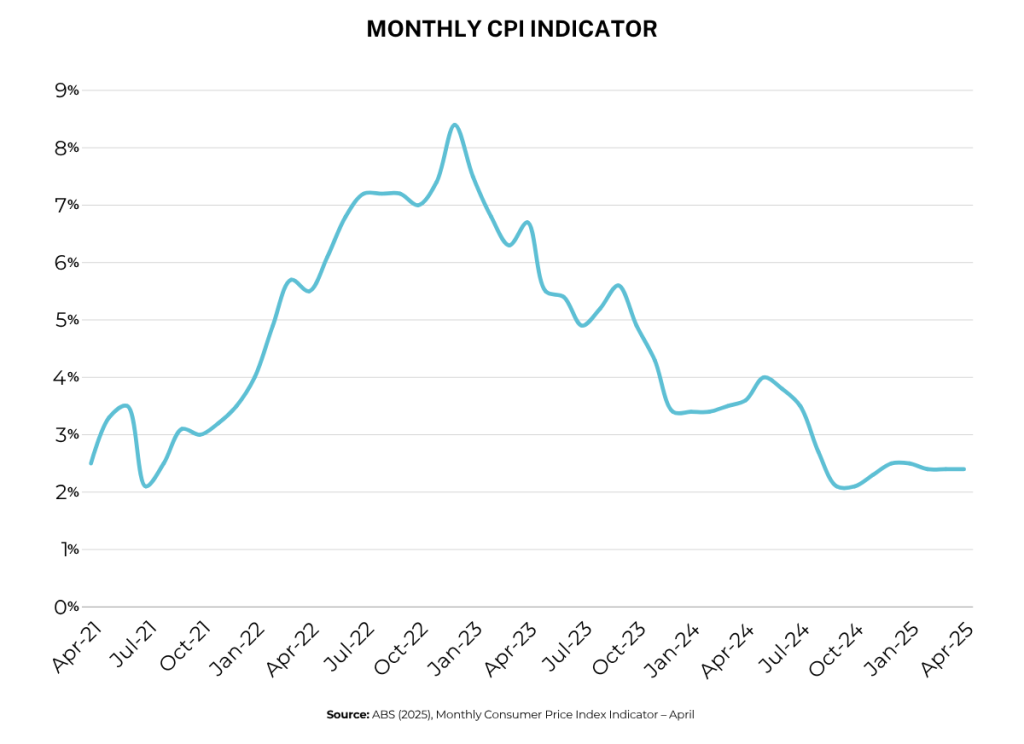

The annual inflation rate in April was 2.4%, based on the latest data from the Australian Bureau of Statistics. That marked the ninth consecutive month headline inflation had been within the RBA’s target range of 2–3%.

More importantly, the ‘trimmed mean’ inflation rate – which the Reserve Bank of Australia (RBA) considers more reliable as it removes volatile price movements – was 2.8%, marking its fifth consecutive month within the target range.

This potentially opens the door for the RBA to make at least one more interest rate cut this year.

The minutes from the RBA’s May 20 monetary policy meeting show that the board believes inflationary pressures have eased significantly. It also noted that “significant and unexpectedly adverse developments in the global economy” could slow domestic growth, further easing inflationary pressure.

That said, the RBA cautioned that inflation risks remain. The scheduled end of federal energy subsidies is expected to increase power prices, while a tight labour market continues to drive strong wage growth. Both factors may exert upward pressure on inflation.

As a result, while many economists forecast rates will fall further in 2025, it remains uncertain.

Need a home loan? Let’s chat.

Hit the button below to arrange a conversation with one of my loan specialists to find a deal that’s best for your situation.

We partner with over 50 lenders so you can find the perfect solution

Share on: