Interest rates are tumbling – should you refinance?

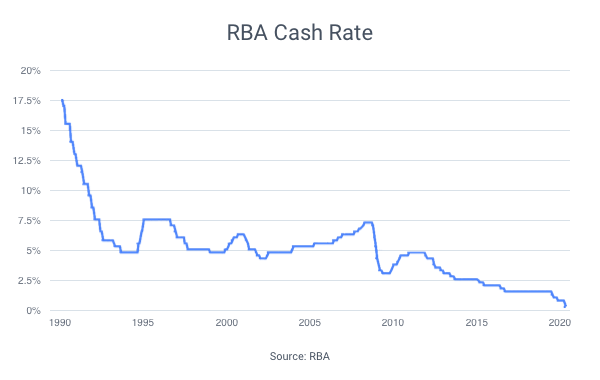

The Reserve Bank of Australia has slashed official interest rates to record-low level at an emergency meeting last week. This was the second rate cut in March, seeing the cash rate drop 50 basis points in less than a month.

In response to the drops, many lenders failed to pass on the entire 50-point saving but almost all made significant reductions.

So now that rates are at an all-time low, is it a good time to find a better home loan?

The answer isn’t so black and white.

Borrowers with a lot of equity in their homes are well-placed to take advantage of these big rate cuts.

Other borrowers, though, might struggle to find savings, because valuers are being very conservative about property values, which means some people might find they have less than 20% equity in their home – making it hard to switch.

If you’re wondering whether to refinance, let’s talk about your specific circumstances and if a better deal exists.

Needing a great deal?

Hit the button below to arrange a conversation with one of my loan specialists to find a deal that’s best for your situation.

We partner with over 50 lenders so you can find the perfect solution

Share on: