Loyal borrowers charged extra on their mortgage

Staying loyal to your bank could cost you thousands of dollars, according to the new Reserve Bank of Australia data.

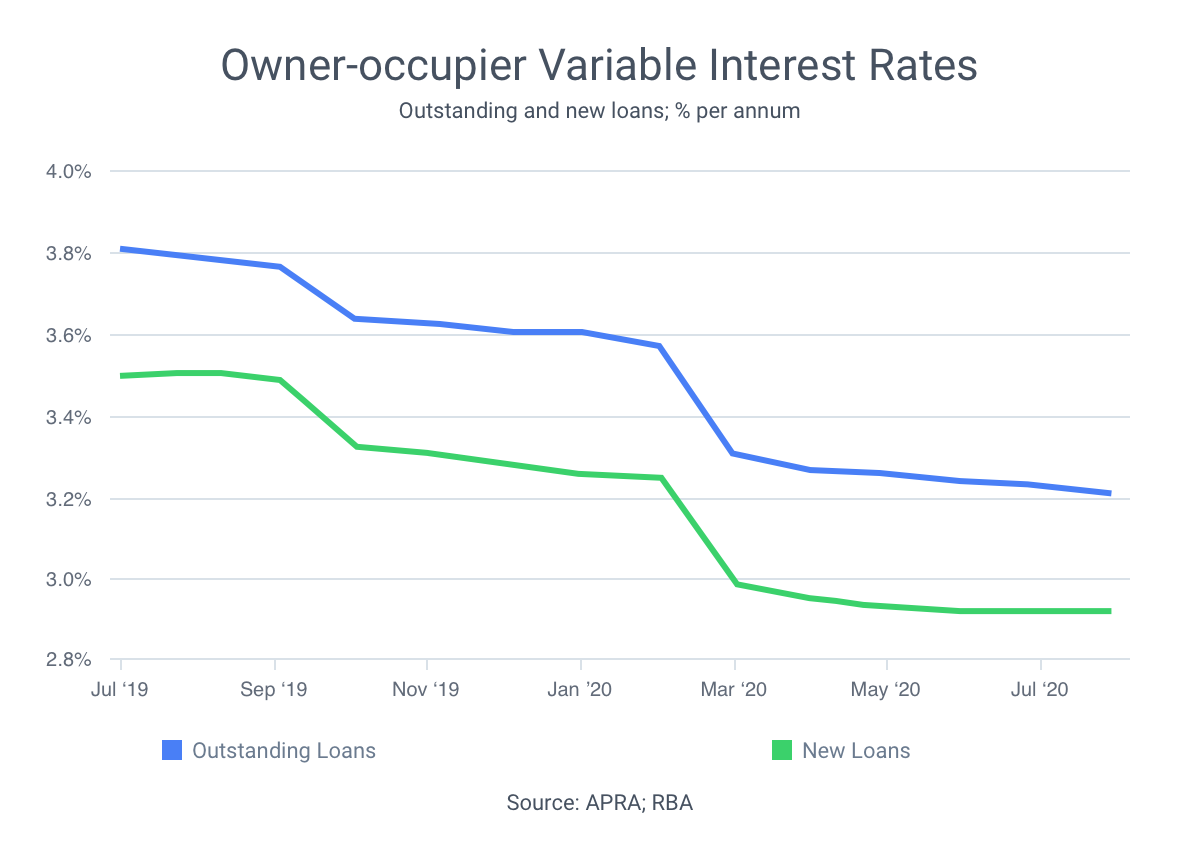

At the end of August, there was a gap of 0.29 percentage points between existing variable owner-occupier mortgages and new ones.

Existing owner-occupiers were being charged an average of 3.21%, while new borrowers were being charged 2.92%.

There are two ways you can avoid paying this ‘loyalty tax’:

- Negotiate a rate cut with your existing lender

- Refinance to a new lender with a lower-rate loan

If you do refinance, make sure the loan you’re switching to doesn’t revert to a higher interest rate at a later date.

Banks compete hard for new customers, but sometimes take existing borrowers for granted, so the longer you stay with one lender, the more likely it is your loan is uncompetitive.

If you’ve got a steady income and you’ve built up equity in your home, you could potentially refinance to a loan with a lower interest rate and lower fees.

Needing a great deal?

Hit the button below to arrange a conversation with one of my loan specialists to find a deal that’s best for your situation.

We partner with over 50 lenders so you can find the perfect solution

Share on: