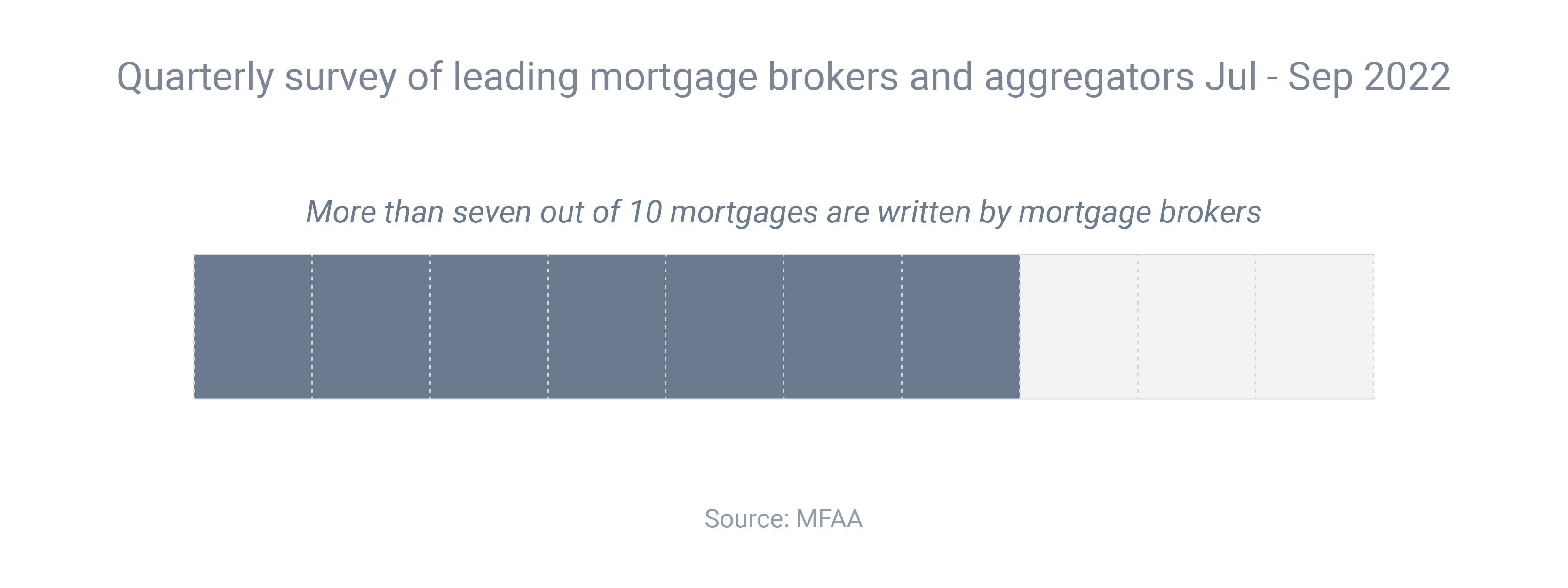

More than 7 in 10 Australians now using a broker

An ever-growing majority of consumers are taking out home loans via mortgage brokers, rather than going direct-to-lender.

Between July and September 2022, mortgage brokers facilitated 71.7% of all new residential home loans – a record share – according to research group Comparator.

That compared to 66.9% the year before and 60.1% the year before that.

Anja Pannek, the chief executive of the Mortgage & Finance Association of Australia, which commissioned the research, said the result highlighted the trust and confidence that consumers have in mortgage brokers.

“With a backdrop of a rising interest rate environment, and with many borrowers reverting from fixed to variable rates in 2023, mortgage brokers are also well placed to support their clients to understand their options and select the product best suited to them,” she said.

“This may include negotiating a more competitive rate with their client’s current lender or refinancing to a different product that is in their best interests.”

Book a free appointment.

Hit the button below to arrange a conversation with one of my loan specialists to find a deal that’s best for your situation.

We partner with over 50 lenders so you can find the perfect solution

Share on: