Buying a home is an exciting milestone, but it also comes with financial responsibilities. One of the most important aspects to consider is your mortgage repayments on a 400k house. Understanding how much you’ll need to pay each month and how that fits into your budget is crucial for making informed decisions.

In this blog post, we’ll dive into the details of mortgage repayments on a 400k house, including factors that affect your monthly payments, tips for managing your finances, and strategies for making the process as smooth as possible. Whether you’re a first-time homebuyer or looking to refinance, this information will help you navigate the world of mortgage repayments with confidence.

What is A Mortgage Repayment?

A mortgage repayment is the amount of money you pay back to a bank or lender when you borrow money to buy a home. When you take out a mortgage, you agree to pay back the loan over a certain period, usually 15 to 30 years. Each month, you make a payment that includes both the money you borrowed and the interest charged by the lender. This payment helps you own your home over time.

For example, if you have a mortgage of 400k, your monthly mortgage repayments will depend on the interest rate and the length of the loan. If the interest rate is low, your payments will be smaller. If the rate is high, your payments will be larger. It’s important to understand how these factors affect your mortgage repayments on 400k so you can budget your money wisely.

Mortgage repayments can also include other costs, like property taxes and insurance. These costs are often added to your monthly payment, so you pay them together with your mortgage. Knowing all the parts of your mortgage repayment helps you plan for homeownership and avoid surprises in your budget.

How Much Deposit Do You Need For A $400,000 Mortgage?

To buy a $400,000 home, the amount you need for a deposit can vary based on the type of mortgage you choose. If you go with a conventional loan, a common requirement is a down payment of 20%, which would be $80,000. However, some lenders allow lower down payments. For example, you could put down as little as 3%, which would amount to $12,000. This option is often available for first-time homebuyers.

Choosing a smaller down payment can make it easier to buy a home, but it may also lead to higher mortgage repayments on 400k due to the larger loan amount and potential private mortgage insurance (PMI) costs.

When considering how much you need to save, it’s essential to think about your total budget. Besides the down payment, there are other costs involved in buying a home, such as closing costs, property taxes, and insurance. These additional expenses can add up, so it’s wise to plan for them. If you put down a smaller deposit, you might face higher monthly payments. For instance, with a 3% down payment, your monthly mortgage repayments on 400k could be around $2,600, depending on the interest rate and loan terms.

How Are Mortgage Repayments Calculated?

Mortgage repayments are calculated based on a few key factors. First, the total amount borrowed, known as the principal, plays a big role. For example, if you take out a mortgage of 400k, this means you are borrowing $400,000. The lender will also consider the interest rate, which is the cost of borrowing money. This rate can be fixed or variable, meaning it can stay the same or change over time. The loan term, or how long you have to pay back the mortgage, is also important. Common terms are 15, 20, or 30 years.

To calculate the monthly payment, lenders use a formula that includes the principal, interest rate, and loan term. The formula helps determine how much you need to pay each month to pay off the loan by the end of the term. For example, if you have mortgage repayments on 400k with a fixed interest rate of 4% over 30 years, your monthly payment will be different than if the interest rate were 5%. This calculation ensures that you pay back both the principal and the interest over the life of the loan.

Another factor to consider is additional costs, such as property taxes and insurance. These costs can be added to your monthly payment, making it higher. It’s important to understand these extra expenses when budgeting for a mortgage. Knowing how mortgage repayments are calculated helps you plan your finances better and choose a mortgage that fits your needs.

Mortgage Repayments On 400k House: Top 10 Australian Lenders

The mortgage repayments on a $400,000 house can vary significantly depending on the lender and the interest rate. Here are the top 10 lenders in Australia, along with details about their offerings.

1. Commonwealth Bank of Australia (CBA)

CBA is one of the largest banks in Australia. They offer competitive rates for mortgage repayments on a $400,000 loan. Their standard variable rate is around 5.49%, resulting in monthly repayments of approximately $2,300 over 30 years. They also provide various features like offset accounts and redraw facilities.

2. Westpac

Westpac is another major player in the Australian mortgage market. Their variable rate for a $400,000 mortgage is about 5.54%. Monthly repayments would be around $2,320. Westpac offers flexible repayment options and the ability to make extra repayments without penalties.

3. ANZ

ANZ provides a competitive variable rate of 5.50% for a $400,000 mortgage. This leads to monthly repayments of about $2,300. They also have various home loan products that cater to different needs, including fixed and split loans.

4. NAB (National Australia Bank)

NAB offers a variable interest rate of 5.55% for a $400,000 mortgage. This results in monthly repayments of around $2,330. NAB is known for its customer service and offers features like an offset account and the ability to redraw funds.

5. ING

ING is known for its low rates and customer-friendly policies. Their variable rate for a $400,000 mortgage is approximately 5.39%. This means monthly repayments would be around $2,290. ING also offers a no-fee option for borrowers who meet certain criteria.

6. Bendigo Bank

Bendigo Bank offers a competitive rate of 5.60% for a $400,000 mortgage. Monthly repayments would be about $2,350. They focus on community banking and offer personalised service to their customers.

7. Suncorp

Suncorp provides a variable rate of 5.70% for a $400,000 mortgage. This translates to monthly repayments of around $2,380. Suncorp also offers a range of home loan products, including fixed and variable options.

8. Bankwest

Bankwest has a variable rate of 5.65% for a $400,000 mortgage, leading to monthly repayments of about $2,360. They offer various loan features, including the ability to make extra repayments and redraw funds.

9. UBank

UBank is a digital bank that offers competitive rates. Their variable rate for a $400,000 mortgage is around 5.49%, resulting in monthly repayments of approximately $2,300. UBank is known for its online services and low fees.

10. Macquarie Bank

Macquarie Bank offers a variable interest rate of 5.75% for a $400,000 mortgage. This results in monthly repayments of about $2,390. Macquarie is known for its flexible loan options and premium service.

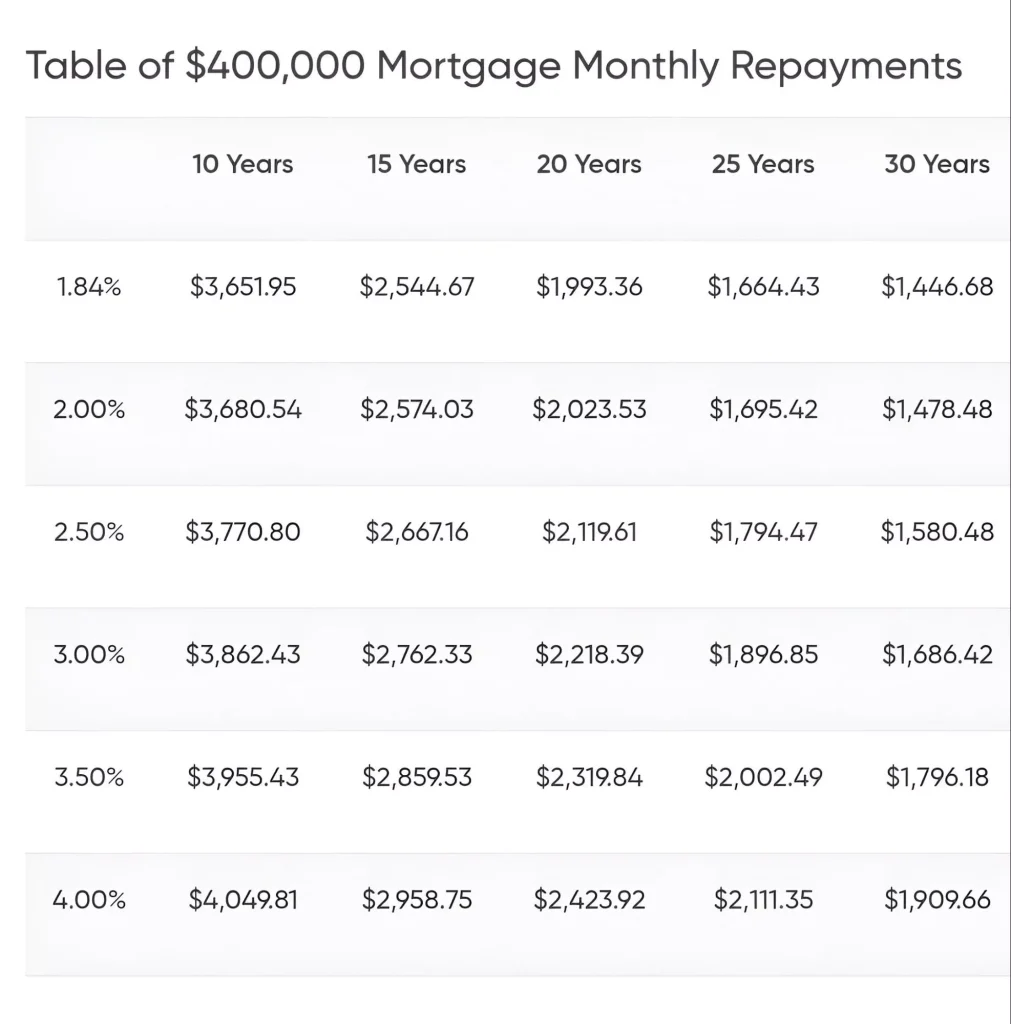

Table of Monthly Mortgage Repayments on 400k House

How Is Interest Calculated For Mortgage Repayments on 400k House?

To calculate the interest for mortgage repayments on a $400,000 house, you first need to know the loan amount. If you put down a 20% down payment, your loan would be $320,000. The bank will then apply the interest rate to this amount. The interest for the first month is calculated by taking the annual interest rate, dividing it by 12 to get a monthly rate, and then multiplying that by the remaining loan balance. So, if your monthly interest rate is about 0.33%, you would multiply that by $320,000 to find out how much interest you owe for the first month.

As you make payments each month, part of your payment goes to interest, and part goes to pay down the loan balance. Over time, the amount of interest you pay each month will decrease because the loan balance gets smaller. This means that in the later years of your mortgage, more of your payment will go toward reducing the principal amount. Understanding how interest is calculated for mortgage repayments on a $400,000 house can help you plan your budget and manage your finances better.

Freshwater Financial Services Can Help You Get The Best Mortgage Repayments on 400k Options

Freshwater Financial Services offers valuable assistance for those looking to secure the best mortgage repayments on 400k options. With a team of experienced mortgage brokers, they help clients navigate the complex world of home loans. Understanding the different interest rates and terms available can be overwhelming, but Freshwater simplifies this process. They work with over 50 lenders, ensuring clients can compare various options and find the best rates suited to their financial situations.

When considering mortgage repayments on 400k, it is essential to look at how interest rates affect monthly payments. For example, a 30-year mortgage at a lower interest rate can significantly reduce monthly costs. Freshwater Financial Services provides tools and calculators to help clients visualise their potential repayments. This clarity allows homeowners to make informed decisions about their financial futures, whether they are first-time buyers or looking to refinance.

Moreover, Freshwater Financial Services emphasises personalised service. They recognize that each client’s financial situation is unique and requires tailored solutions. By understanding individual needs and goals, they can guide clients toward the best mortgage options. This approach not only helps in achieving lower mortgage repayments on 400k but also sets clients on a path to financial stability and success.

Conclusion

Understanding mortgage repayments on 400k is crucial for anyone looking to purchase a home. By working with experienced professionals like those at Freshwater Financial Services, homebuyers can navigate the complexities of home loans and find the best rates suited to their financial situations. With a wide range of lenders and personalised service, clients can make informed decisions about their mortgage options, ultimately leading to lower monthly payments and a more secure financial future.

FAQ's

Yes, you can reduce your mortgage repayments. Using a home loan repayment calculator can help you see how changes in your loan terms or current interest rate affect your payments. If you have a variable rate home loan, you might benefit from lower rates, which can also lower your home loan repayments.

With a salary of $100,000 in Australia, you can borrow around $528,233 for a home loan. When considering mortgage repayments on this amount, it’s important to look at the total interest you will pay over the life of the loan. You should also compare repayments from different lenders to find the best repayment amount that fits your budget.

The monthly payment on a $400,000 mortgage can vary based on the type of loan. For principal and interest repayments, a 30-year mortgage at a 6% interest rate would cost about $2,399 a month. If you choose interest only repayments, the monthly payment would be around $2,334 at a 7% interest rate, so it’s helpful to use a mortgage repayment calculator to see the exact amounts based on your situation.

Yes, you can get a home loan with a 70k salary. Lenders will look at your income and expenses to decide what loan type you can afford. You might consider a fixed rate loan or a variable home loan, and you can also make additional repayments to pay off your loan faster.

Interest rates are expected to remain high for most of 2024, with predictions suggesting they will average around 6.8% to 7% for 30-year fixed mortgages. While there may be a chance for some slight decreases later in the year, significant drops are not likely. Mortgage repayments on 400k will still be impacted by these elevated rates, making it essential for buyers to plan accordingly.

A 5/1 adjustable rate mortgage (ARM) is a type of home loan where the interest rate is fixed for the first 5 years, and then adjusts annually after that. This means your monthly payments may change after the initial 5-year period. With a 5/1 ARM, you have the option to refinance or make early repayment of your existing loan if you want to avoid potential increases in your repayment frequency or minimum repayment amount.

Yes, home loan repayment calculators are important because they help you understand how much you will need to pay each month for your mortgage. These calculators show you how different interest rates and loan terms affect your monthly payments. Using a repayment calculator can help you make a more informed decision when choosing a mortgage that fits your budget.

Get in touch if you need a construction loan.

Hit the button below to arrange a conversation with one of my loan specialists to find a deal that’s best for your situation.

We partner with over 50 lenders so you can find the perfect solution

Share on: