National property prices rose 8.1% last year

Australia’s median property price reached a record $757,746 at the end of 2023, after another year of growth.

The median price rose 3.0% during the pandemic year of 2020, surged 24.5% in 2021, contracted 4.9% in 2022 and then climbed another 8.1% in 2023, according to CoreLogic.

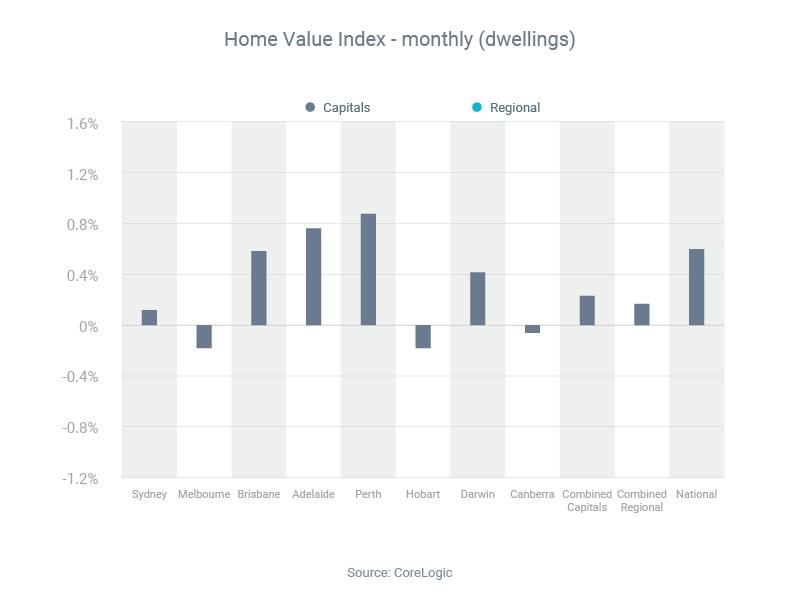

The median price for the combined capitals ended 2023 at record levels, while the combined regions were just 1.5% off peak.

December was the 11th consecutive month of price gains (see graph) – however, as CoreLogic research director Tim Lawless noted, it was also the smallest of those monthly gains, at 0.4%.

“After monthly growth in home values peaked in May at 1.3%, a rate hike in June and another in November, along with persistent cost of living pressures, worsening affordability challenges, rising advertised stock levels and low consumer sentiment, have progressively taken some heat out of the market through the second half of the year,” he said.

As interest rates move up and down, so does the average person’s borrowing power. Borrowing power tended to decline in 2023 and is likely to change again in 2024 as rates evolve. The other point worth mentioning is that your borrowing power can vary significantly from lender to lender. The good news is that I can match you with a bank that wants to lend to someone with your situation.

Talk to me about your borrowing power

Hit the button below to arrange a conversation with one of my loan specialists to find a deal that’s best for your situation.

We partner with over 50 lenders so you can find the perfect solution

Share on: