New home purchases rise 5.3%

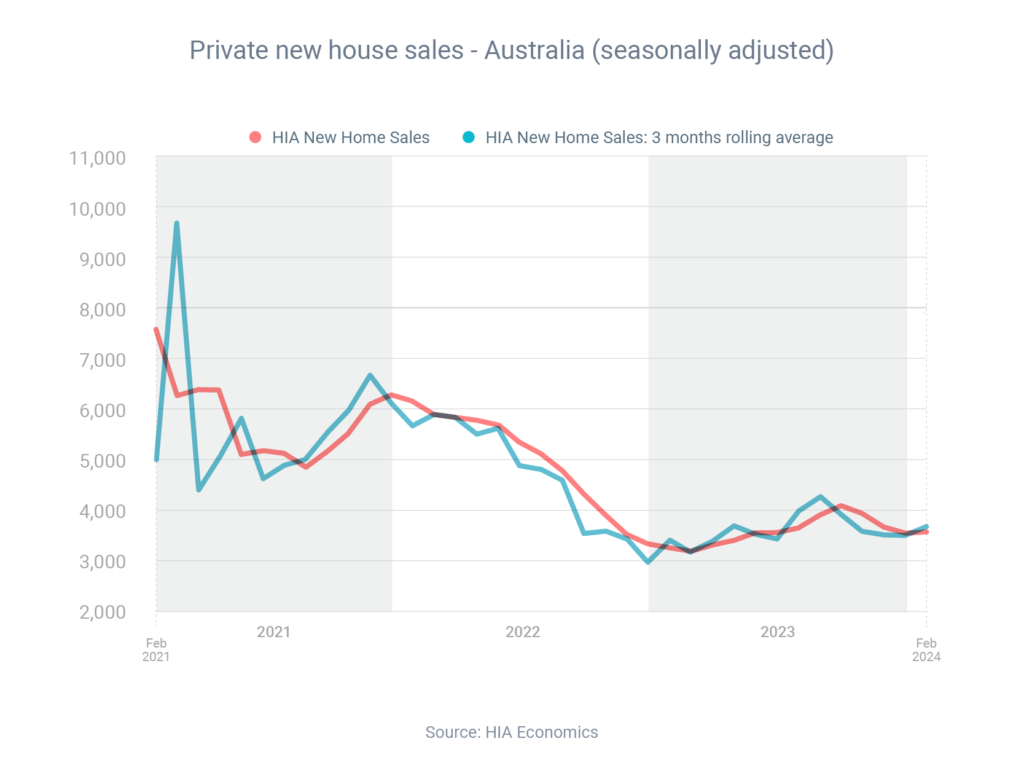

Australians purchased 5.3% more new homes in February than the month before, according to the Housing Industry Association (HIA).

However, HIA chief economist Tim Reardon said this increase was off a “very low” base. Based on the number of new homes being approved for construction and purchased, he forecast there would be a decade-low amount of homebuilding activity in 2024, despite the pent-up demand for housing.

Nevertheless, banks are still keen to lend to Australians who want to build a new home or renovate an existing one. To finance your project, you’ll need a construction loan (rather than a regular home loan). Here’s how construction loans work:

- To apply for a loan, you need to provide the lender with your building contract, building plans and council approvals

- You receive the money in stages (usually five) throughout the project, rather than one lump sum at the start

- You pay interest only on the portion of the loan you’ve received, not the entire amount

- Construction loans typically have terms of 12-24 months; they may then revert to a standard home loan

Get in touch if you need a construction loan.

Hit the button below to arrange a conversation with one of my loan specialists to find a deal that’s best for your situation.

We partner with over 50 lenders so you can find the perfect solution

Share on: