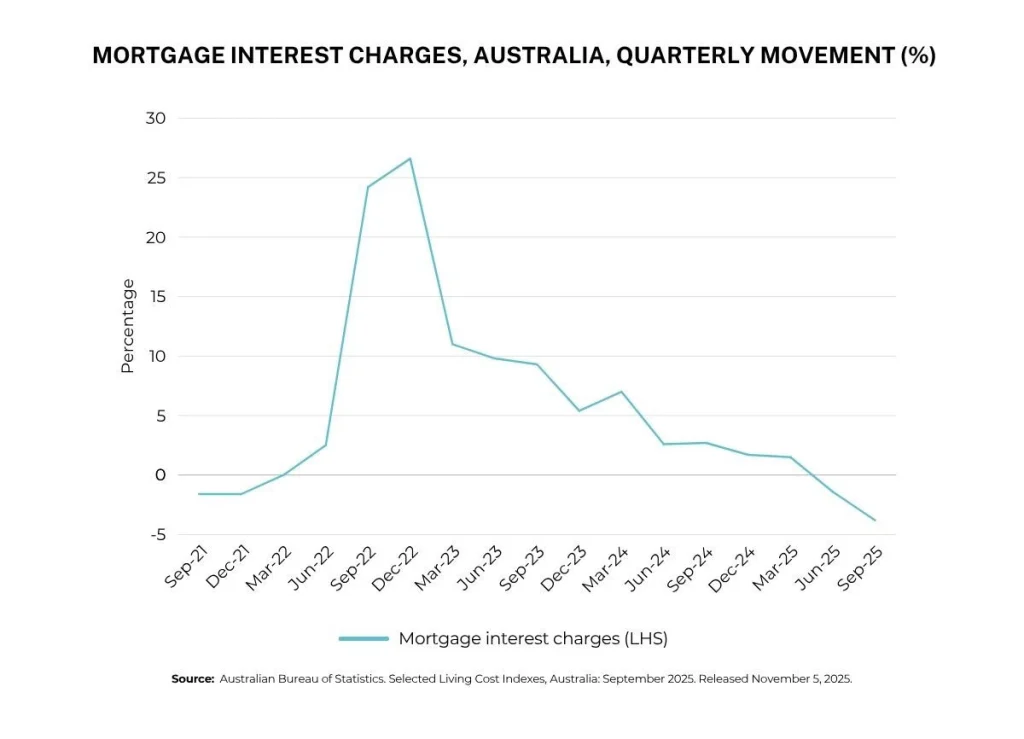

Rate cuts easing repayment pressure

Good news if your budget’s been under pressure – mortgage interest charges are finally moving in the right direction.

The Australian Bureau of Statistics reports mortgage interest costs dropped 1.4% in the June quarter and another 3.8% in the September quarter, helped by three rate cuts earlier this year.

How borrowers are taking advantage of lower rates

- Rebuilding savings buffers. A small monthly lift can add up fast.

- Putting extra into their loan. Helpful while rates settle into a new range.

- Reviewing their loan. There are big differences between some lenders.

Why this matters

Even though rates have fallen, you might still be on a loan priced for old conditions. Lenders are shifting sharply right now, and the ‘lazy tax’ can creep in if you stay put without checking.

A quick check can show where you stand

If you want to see whether your rate is still competitive, I can review it quickly and show you what your savings might look like if you stayed, renegotiated or switched.

Compare your rate to today’s market

Hit the button below to arrange a conversation with one of my loan specialists to find a deal that’s best for your situation.

We partner with over 50 lenders so you can find the perfect solution

Share on: