Switching lenders has never been more popular

Refinancing has reached record levels, according to new data from the Australian Bureau of Statistics.

A record 33,712 Australians refinanced in May, the most recent month for which there are stats. That was up 30% on April, which was itself a record.

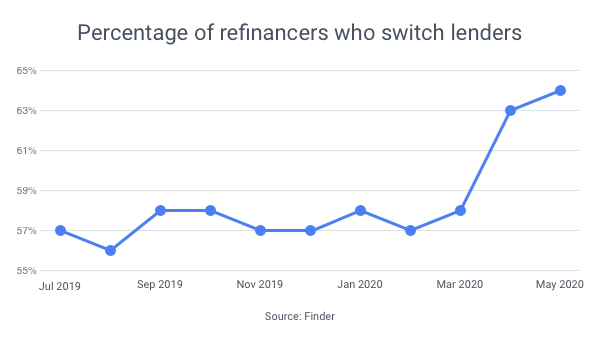

Of those who refinanced, 64% moved to another lender, while 36% stayed with their current provider.

There are two reasons why refinancing is so popular:

- Interest rates are at record-low levels

- Lenders are competing hard for business, with cashback offers and other deals

While refinancing is a good decision for many borrowers, it won’t suit everyone. Here are some questions to ask:

- Will you have to pay money to close your current loan early?

- Will you be forced to pay LMI (lender’s mortgage insurance) if you switch?

- Will your new loan revert to a higher interest rate after a honeymoon period?

Want to refinance?

I can help. Hit the button below to arrange a conversation with one of my loan specialists to find a deal that’s best for your situation.

We partner with over 50 lenders so you can find the perfect solution

Share on: