Variable-rate loans scale new heights of popularity

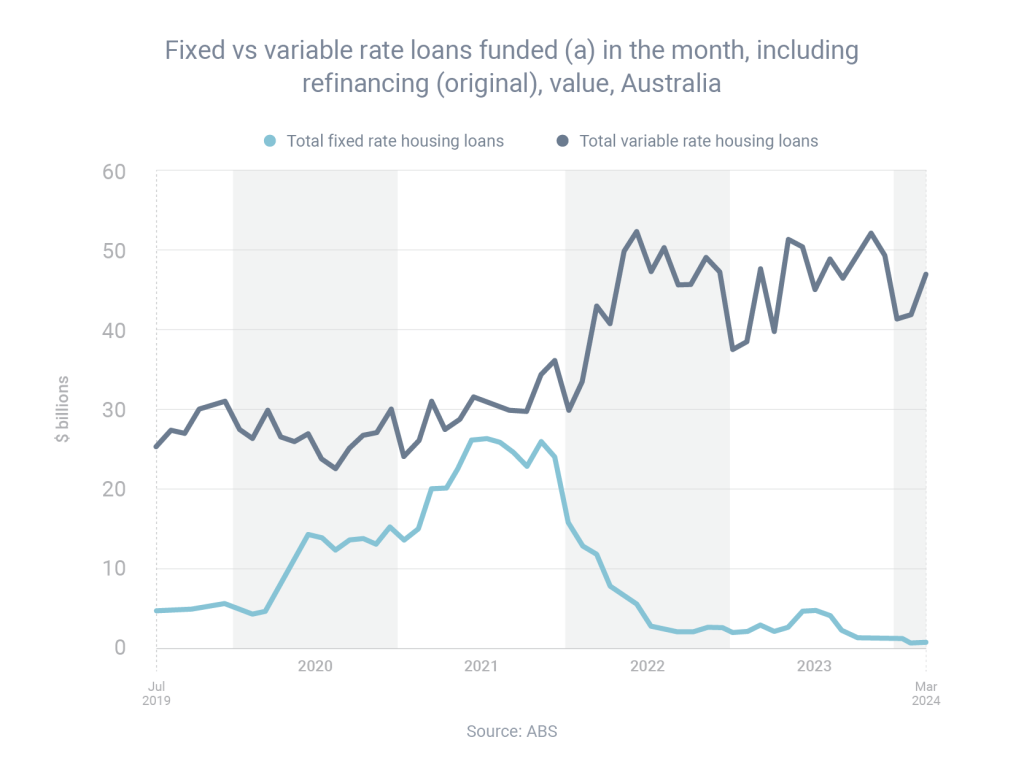

Back in March 2020, at the start of the pandemic, 13.38% of new borrowers were choosing fixed-rate loans and 86.62% were choosing variable. But in March 2024, a staggering low of only 1.40% of new loans were fixed, compared to 98.60% variable, according to the Australian Bureau of Statistics.

The reason so many borrowers are going variable right now is because of a widespread belief that interest rates are at or near their peak, which means variable borrowers would benefit from any future rate cuts. Conversely, in July 2021, when interest rates were at record-low levels, 46.02% loans were fixed, while only 53.98% were variable.

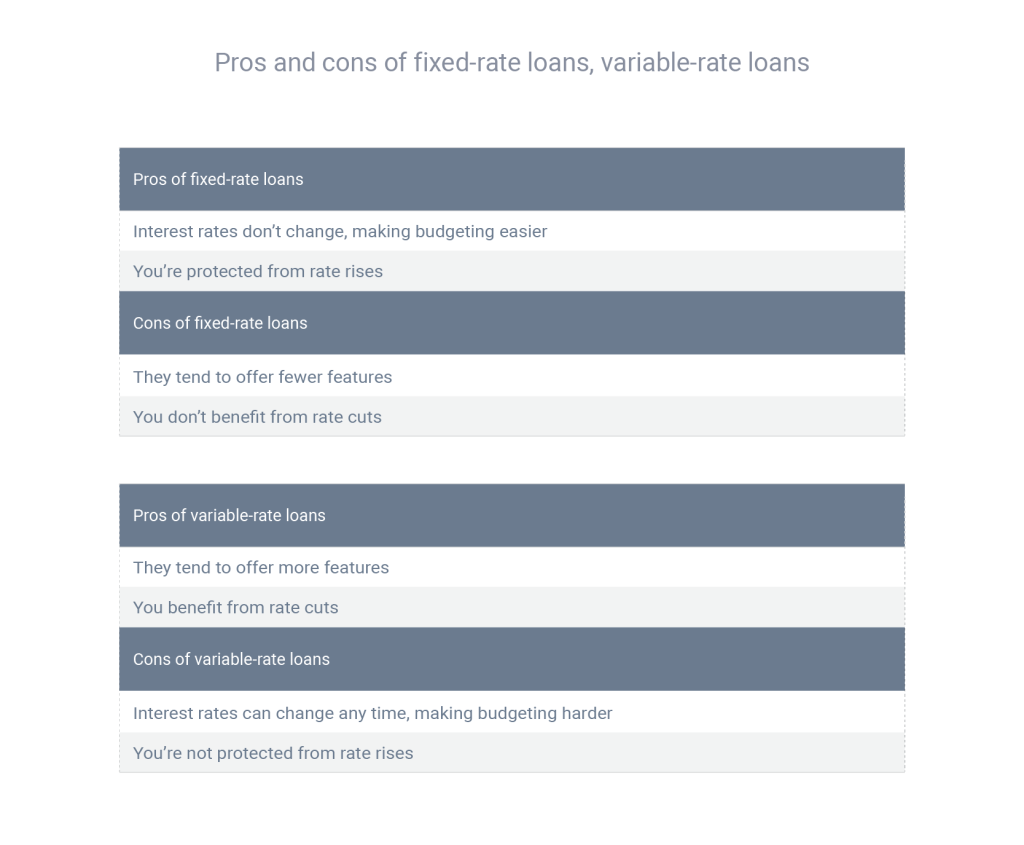

If you’re wondering whether fixed or variable is right for you, here are the main pros and cons of each option:

Get expert help comparing fixed & variable loans

Hit the button below to arrange a conversation with one of my loan specialists to find a deal that’s best for your situation.

We partner with over 50 lenders so you can find the perfect solution

Do you have questions about mortgages or loans?

Ask us in the comments below