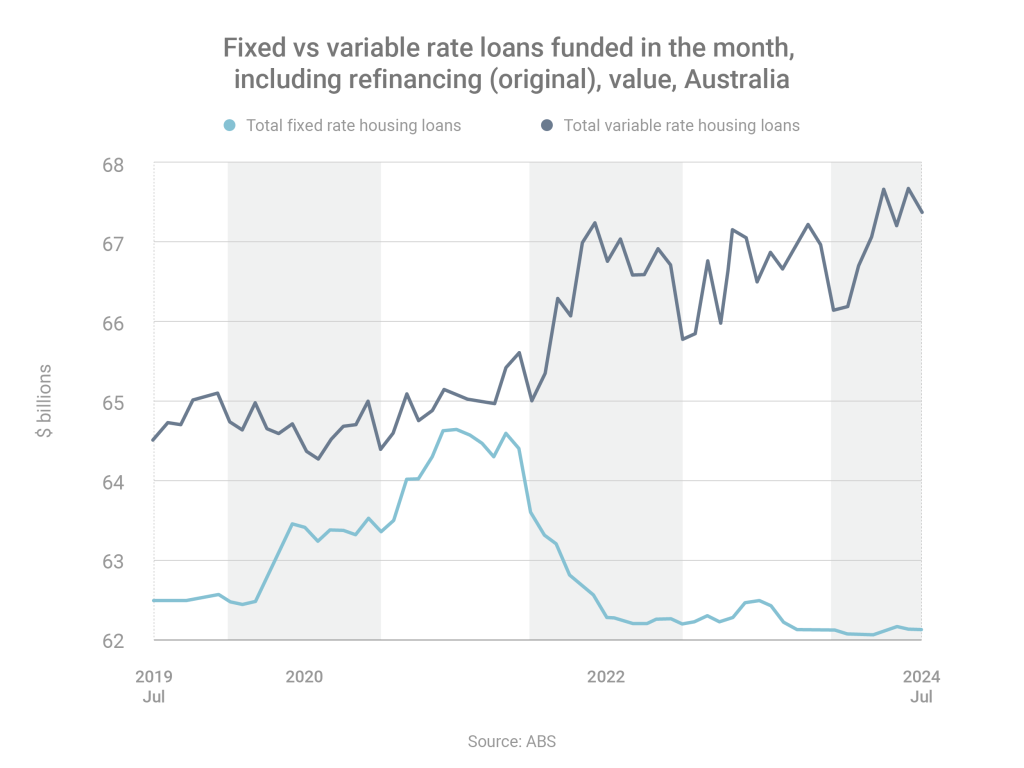

Why 98% of borrowers are going variable right now

The vast majority of home loan customers are currently choosing variable-rate loans over fixed-rate loans.

In August 2024, 98% of new loans were variable, while 2% were fixed, according to the most recent data from the Australian Bureau of Statistics.

By comparison, in August 2021, when interest rates were at record-low levels, 46% of borrowers decided to fix, while 54% went variable.

Interest rate expectations appear to be guiding borrowers’ decisions.

In 2021, when rates were at ultra-low levels due to the pandemic, most borrowers assumed they would rise sooner or later – so many chose to lock in those lower rates.

Today, most borrowers assume rates have peaked, so they want a variable loan that will get cheaper if and when the Reserve Bank of Australia starts reducing the cash rate.

Fixed vs variable:

- Fixed loans simplify budgeting, because your monthly repayments won’t change during the fixed period

- As a result, you won’t suffer when rates rise and won’t benefit when they fall

- Variable loans are unpredictable, because your repayments can change at any time

- Variable rates go higher when rates rise and lower when they fall

Want a competitive rate? Let’s talk

Hit the button below to arrange a conversation with one of my loan specialists to find a deal that’s best for your situation.

We partner with over 50 lenders so you can find the perfect solution

Share on: