Why you might want to switch from renting to buying

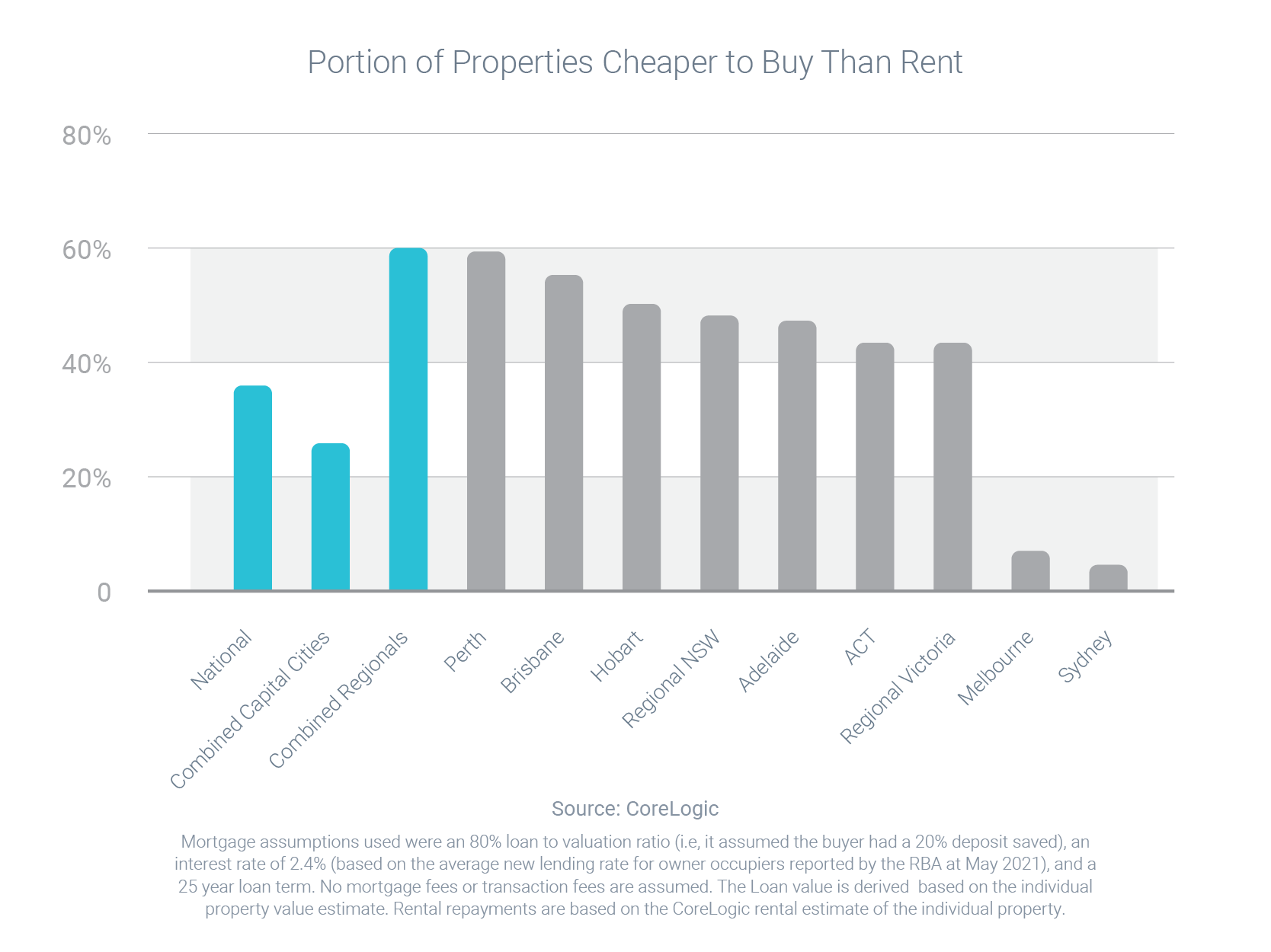

New analysis from CoreLogic has found that buying a property is cheaper than renting for 36.3% of homes across Australia.

This is an improvement on the last time this analysis was conducted, in February 2020, when it was cheaper to buy than rent 33.9% of homes.

‘Cheaper to buy’ means it takes less money to meet ongoing mortgage repayments than ongoing rental payments. CoreLogic’s analysis assumed borrowers would put down a 20% deposit, take out a 25-year loan and pay a mortgage rate of 2.40%.

The national results hide a lot of geographical variation. For example, a majority of homes in regional locations are cheaper to buy (60.1%) but only a minority in metro locations (28.2%).

Of course, these are broad averages, so your personal situation might be different. If you want an expert to crunch the numbers on your behalf and see what impact a mortgage would have on your finances, get in touch.

Looking to buy? I can help.

Hit the button below to arrange a conversation with one of my loan specialists to find a deal that’s best for your situation.

We partner with over 50 lenders so you can find the perfect solution

Share on: