Refinancing activity is at ultra-high levels right now, as owner-occupiers and investors alike try to find home loans with lower interest rates as the Reserve Bank continues to raise the cash rate.Borrowers refinanced a record $19.5 billion of loans in November, the most recent month for which we have data, according to the Reserve Bank of Australia.By way of comparison, that was 20.4% higher than the year before and 88.2% higher than two years before. The Reserve Bank has hinted that at least one more rate rise is coming. In December, it said it wanted to "return inflation to the 2-3% target range over time" (it's currently 7.3%) and would “do what is necessary to achieve that outcome" – i.e. further increase the cash rate.So if it’s been a while since you took out your home loan, now would be a good time to think about refinancing.Contact me to get the ball rolling. I’ll be happy to crunch the numbers for you, so you can see if refinancing would be suitable for you and how much money you could save by switching to a comparable lower-rate loan.Want to compare interest rates? Let's talk.Hit the button below to arrange a conversation with one of my loan specialists to find a deal that's best for your situation. Chat to us today We partner with over 50 lenders so you can find the perfect solutionFollow Facebook Linkedin Do you have questions about mortgages or loans?Ask us in the comments below … [Read more...] about Borrowers refinance a record $19.5bn of home loans

More than 7 in 10 Australians now using a broker

An ever-growing majority of consumers are taking out home loans via mortgage brokers, rather than going direct-to-lender.Between July and September 2022, mortgage brokers facilitated 71.7% of all new residential home loans – a record share – according to research group Comparator.That compared to 66.9% the year before and 60.1% the year before that. Anja Pannek, the chief executive of the Mortgage & Finance Association of Australia, which commissioned the research, said the result highlighted the trust and confidence that consumers have in mortgage brokers."With a backdrop of a rising interest rate environment, and with many borrowers reverting from fixed to variable rates in 2023, mortgage brokers are also well placed to support their clients to understand their options and select the product best suited to them," she said."This may include negotiating a more competitive rate with their client's current lender or refinancing to a different product that is in their best interests."Book a free appointment.Hit the button below to arrange a conversation with one of my loan specialists to find a deal that's best for your situation. Chat to us today We partner with over 50 lenders so you can find the perfect solutionFollow Facebook Linkedin Do you have questions about mortgages or loans?Ask us in the comments below … [Read more...] about More than 7 in 10 Australians now using a broker

Most borrowers favouring lower-rate variable loans right now

Very few borrowers are currently fixing their home loans – unlike a year earlier when about half of borrowers were doing so.In October 2022, the most recent month for which we have data, only 4% of borrowers fixed their loans (both new loans and refinances), according to the Australian Bureau of Statistics.By contrast, 44% of borrowers fixed in October 2021 and 46% in August 2021 (when fixing peaked).While the Reserve Bank only started increasing the cash rate in May 2022, lenders knew it was coming, so they’d already started raising interest rates on their fixed-rate loans. In response, borrowers had begun shifting towards lower-rate variable loans.This is confirmed by Reserve Bank data on new owner-occupied loans. In October 2021, the average interest rate on a new fixed loan (with a fixed periodd of three years or less) was 0.63 percentage points lower than a new variable loan.By February 2022, new fixed loans had become 0.09 percentage points dearer; by May they'd become 0.70 percentage points dearer.That has since declined – by October, they were only 0.30 percentage points dearer.Compare fixed and variable interest rates.Hit the button below to arrange a conversation with one of my loan specialists to find a deal that's best for your situation. Chat to us today We partner with over 50 lenders so you can find the perfect solutionFollow Facebook Linkedin Do you have questions about mortgages or loans?Ask us in the comments below … [Read more...] about Most borrowers favouring lower-rate variable loans right now

The biggest six months in refinancing history

The latest data from the Australian Bureau of Statistics has revealed that enormous numbers of borrowers are refinancing their home loans.Australians refinanced $17.8 billion of mortgages in October – not far off the record $18.6 billion of refinancing that occurred in August.Indeed, the past six months have been the six biggest months in refinancing history.Part of the reason so many borrowers are refinancing right now is because many lenders charge lower interest rates to new borrowers than loyal customers, as shown by Reserve Bank data.In October, owner-occupiers who took out new variable loans were charged, on average, 0.51 percentage points less than owner-occupiers with existing loans.Refinancing to a comparable lower-rate loan could potentially save you tens of thousands of dollars over the life of your loan. I’d be happy to explain the pros and cons of refinancing, and to crunch the numbers to see how much you might be able to save by switching loans.Reach out if you want to refinance.Hit the button below to arrange a conversation with one of my loan specialists to find a deal that's best for your situation. Chat to us today We partner with over 50 lenders so you can find the perfect solutionFollow Facebook Linkedin Do you have questions about mortgages or loans?Ask us in the comments below … [Read more...] about The biggest six months in refinancing history

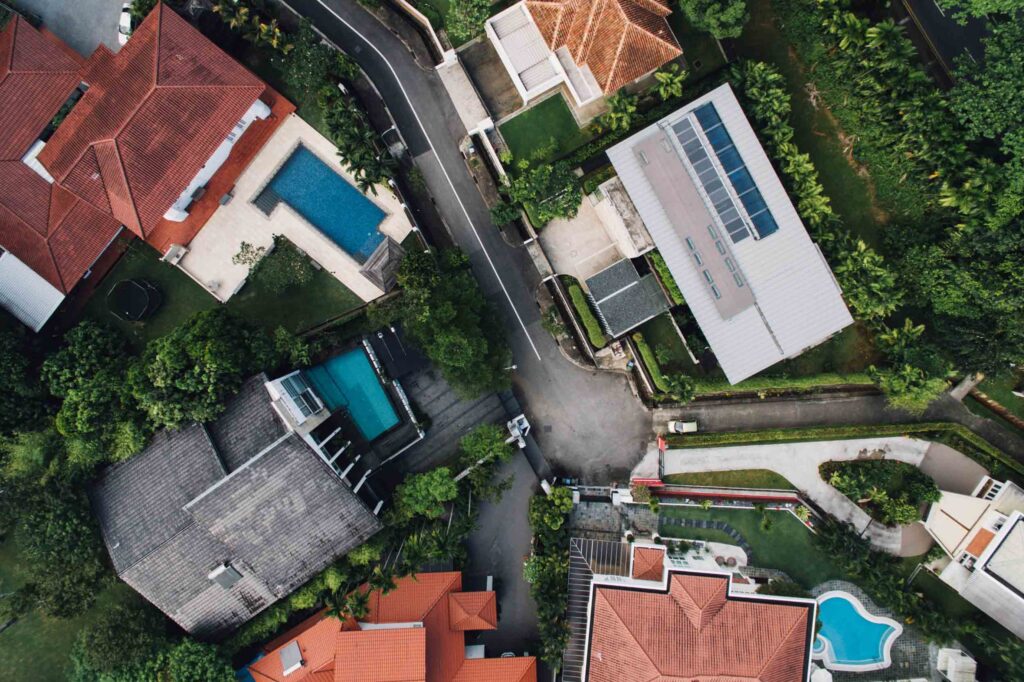

Property prices fell in 2022 but forecast to rise again in 2023

The property market has changed significantly over the past 12 months.In the year to November 2021, the national median property price jumped 22.2%, according to CoreLogic. But in the year to November 2022, prices fell 3.2%.Some capital cities actually recorded price growth in the year to November 2022:Adelaide +13.4%Darwin = +5.5%Perth +3.9%Brisbane +3.3%But prices declined in the other capitals:Canberra -1.3%Hobart -4.1%Melbourne -7.0%Sydney -10.6%That said, every capital city’s median price declined in the three months to November 2022, suggesting all markets are going backwards right now.However, SQM Research believes most cities will return to growth mode in 2023.SQM has provided four different forecasts, based on different scenarios around interest rates, inflation and unemployment. Under the ‘base case’ scenario, SQM has predicted the following price changes:Sydney +5% to +9%Perth +4% to +8%Melbourne +1% to +5%Brisbane +1% to +5%Adelaide 0% to +5%Hobart -1% to +3%Canberra -3% to +2%Darwin -5% to 0%Thinking of buying next year? Let's talk.Hit the button below to arrange a conversation with one of my loan specialists to find a deal that's best for your situation. Chat to us today We partner with over 50 lenders so you can find the perfect solutionFollow Facebook Linkedin Do you have questions about mortgages or loans?Ask us in the comments below … [Read more...] about Property prices fell in 2022 but forecast to rise again in 2023

5 Challenges Faced by First-Time Home Buyers

Home purchases are usually put off since they involve a significant financial commitment in addition to a substantial amount of effort. However, there are methods to make the process of purchasing a home simpler. Owning a home is a long-term decision that may not only provide you with significant returns on your investment but is also known to bring about a great deal of happiness and security.Still have some questions that haven't been answered? We have put up a helpful guide for first-time homebuyers in Sydney that explains how to overcome the numerous obstacles that stand in the way of purchasing a property. Let's discuss some of the most common roadblocks to ownership and what you can do to ensure you overcome them.1. The Initial PaymentA major obstacle for first-home buyers in Sydney is having enough cash on hand for a down payment. A standard mortgage normally requires borrowers to put down 20% of the home's purchasing price. Finding a 20% down payment for a first-time home purchase might be challenging, if not nearly impossible. The good news is that down payments are no longer as much of a barrier as they once were.There are several mortgage alternatives available to borrowers today, including low- and no-down-payment loans.2. Finding a Good PropertyFinding a suitable house that fulfils all of their specifications is one of the biggest issues first-time buyers have. Therefore, you might need to consider moving to a new area if you have trouble finding a home that meets your requirements for price, schools, green space, and other criteria. To maximize your chances of finding the ideal fit, it is crucial to thoroughly explore every sector you have chosen. Additionally, it could be advantageous to hunt for a developing location, which is typically situated close to growing neighboring towns.3. Putting Money Aside for a MortgageFirst of all, because your deposit is the biggest item you will be saving for, saving for your first house might seem like an impossible undertaking. Typically, the down payment must equal at least 5% of the property's cost in order to qualify for a mortgage that will cover the remaining balance. To ensure this figure is more attainable, you will need to create a detailed and practical strategy. To obtain a general notion of how much you should aim for, it could be useful to look at houses in the neighborhood you want to purchase in.4. Mortgage SecuringLenders have tightened their affordability requirements over the past few years, which has made it harder for borrowers to get a fair offer. Sydney’s first home buyers expert, like Fresh Water, could be able to help you if your credit score isn't in great shape. They will put you in touch with a mortgage specialist with experience in your situation who will be able to assist you through the process as well as be available to answer any questions you may have. As a consequence, when the case has been evaluated specifically, you will receive professional guidance on … [Read more...] about 5 Challenges Faced by First-Time Home Buyers

Home builders working through “record pipeline” of projects

There are a record number of homes under construction, according to the latest data from the Australian Bureau of Statistics.A total of 241,926 home builds were underway in the June quarter, which was up 0.7% from the previous record result recorded in the quarter before.On the surface, that would suggest the federal government's plan to build one million new homes (see previous story) in five years is realistic.However, as Housing Industry Association economist Tom Devitt pointed out, there are "more houses still being commenced than completed", which means this "record pipeline" of building work is due to limited supply rather than overwhelming demand. "Supply constraints are continuing to hold back completion of these projects. Materials constraints have plagued builders over the last two years, and shortages of skilled trades have only become more acute," he said."These supply constraints will keep Australia’s home builders busy this year and next as they continue to work down this record volume of detached house projects."Want to build? I can help you get finace. Hit the button below to arrange a conversation with one of my loan specialists to find a deal that's best for your situation. Chat to us today We partner with over 50 lenders so you can find the perfect solutionFollow Facebook Linkedin Do you have questions about mortgages or loans?Ask us in the comments below … [Read more...] about Home builders working through “record pipeline” of projects

New housing accord to deliver 1m new homes

The federal government has rolled out a new policy to address what it calls “one of our nation’s biggest economic challenges” – housing affordability.The National Housing Accord, which was unveiled in the recent Budget, aims to improve affordability by building one million new well-located homes over five years from 2024.What makes the accord unique is that, for the first time, it aligns the efforts of governments, institutional investors and the construction sector.The role of the construction sector will be to build homes that are more energy-efficient and to train more apprentices.Institutional investors, like superannuation funds, will be expected to fund development projects "for their members’ interests and for the national interest". As for governments:The federal government will provide financing options to facilitate institutional investment in social and affordable housingStates and territories will expedite zoning, planning and land release for social and affordable housingCouncils will deliver planning reforms and free up land for new buildsWhether you want to build a new home or buy an existing home, it's important you get your finances in order so you maximise your chances of qualifying for a loan.Three ways to make yourself more creditworthy are to:Pay all your bills on time;Reduce your expenses; andIncrease your income.Contact me if you need a pre-approval. Hit the button below to arrange a conversation with one of my loan specialists to find a deal that's best for your situation. Chat to us today We partner with over 50 lenders so you can find the perfect solutionFollow Facebook Linkedin Do you have questions about mortgages or loans?Ask us in the comments below … [Read more...] about New housing accord to deliver 1m new homes