Mortgage brokers were responsible for 66.5% of all new home loans in the December quarter, according to the latest data from research group Comparator.That is not only a record for a December quarter, it's also a significant increase on the market share brokers recorded in December 2020 (59.4%) and December 2019 (55.3%). Mike Felton, the CEO of the Mortgage & Finance Association of Australia, said the strong increase in mortgage broker market share shows that consumers really value the service, competition and choice that brokers provide.When you visit a bank for home loan advice, the bank will only tell you about its own products, even if it knows another lender is offering a better home loan.But when you visit a broker, the broker will compare interest rates, loan features and borrowing criteria from a range of lenders. The broker will also negotiate with lenders on your behalf. That significantly increases your chances of getting a great loan that’s tailored to your unique circumstances.Want to compare interest rates? Let's talk. Hit the button below to arrange a conversation with one of my loan specialists to find a deal that's best for your situation. Book a review today We partner with over 50 lenders so you can find the perfect solutionFollow Facebook Linkedin Do you have questions about mortgages or loans?Ask us in the comments below … [Read more...] about More and more Australians choosing brokers over banks

HOW MUCH DEPOSIT DO FIRST HOME BUYERS NEED:

To receive a house loan or mortgage, first-time buyers Sydney will almost always need to put down a deposit. There are, however, a variety of loan packages available, many of which have varied initial deposit requirements. With this in mind, how much of a down payment do you need to get a mortgage on your first home? Purchasing a First Home with a 20% Down payment: Securing a house loan for first-time home purchasers might be tough since they do not own a home. A house buyer would often sell their present home to fund the purchase of their new home, or they may use their current home as collateral on their new owner-occupier mortgage. Both choices are unfortunately unavailable to first-time customers. This is why first-time buyers will often require a larger down payment, lowering the proportion of the total purchase price they must borrow. A payment of up to 20% of the total purchase price lowers the loan-to-value ratio (LVR), making the buyer a more appealing prospect to lenders. Purchasing a First Home with a 5% Down Payment: A 20% down payment is not required for all borrowers. First-time home buyers may be able to borrow the cash they require with a much smaller down payment — as little as 5% in some cases. While this may help you to purchase a home sooner, it may also have drawbacks. If you put down a smaller deposit, you'll have fewer loan options and the loan term will be longer, potentially exposing you to higher interest rates. You also pose a higher risk to the lender, and as a result, you'll likely have to pay extra over the life of the loan (we'll go through Lenders' Mortgage Insurance in more depth below). Furthermore, loan products requiring a 5% deposit will be subject to tougher lending criteria, and you will be required to demonstrate that you have a good credit history with low levels of ongoing loan and credit card debt. Purchasing a First Home with a 2% Deposit: The Australian federal government can help single parents acquire a family home with a 2% deposit. The Family House Guarantee is available to both first-time homebuyers and individuals who have previously acquired a home. The government has committed to offering 10,000 Family Home Guarantees to customers who match the loan conditions between 2021 and 2025 as part of the initiative. This implies that in some situations, house buyers may be able to obtain a mortgage with as little as a 2% down payment. Those who take advantage of the program may be eligible for additional types of help, such as homeowner grants, when they purchase a home. The Benefits of a Larger Down Payment: Finding the minimum permissible deposit requirement isn't always in your best interests. You are effectively obtaining a share in your house by paying a deposit. The greater the deposit, the less you'll have to pay back on the property loan, which means you'll save money by reducing the loan term. A larger deposit minimises the lender's risk, which means Lenders' Mortgage Insurance … [Read more...] about HOW MUCH DEPOSIT DO FIRST HOME BUYERS NEED:

Why your student loan can make it harder to get a home loan

When it comes to classifying debt as either ‘good’ or ‘bad’, borrowing to fund your education or buy a property are generally regarded as good debt, because both tend to deliver a return on investment.However, you might not realise that taking on HECS-HELP debt can make it harder to qualify for a home loan and reduce your borrowing capacity.That’s because, if hundreds of dollars per month are being diverted from your salary to repay your student debt, that means you have less money to devote to mortgage repayments.So does that mean you should repay your HECS-HELP loan as soon as possible?Maybe yes, maybe no. On the one hand, eliminating your student debt could make it easier to get a home loan. On the other hand, student debt is interest-free (although it does increase in line with inflation), so it might be better to repay other interest-incurring loans first.Give me a call if you want to know the best approach for your situation or your child’s situation.Contact me for expert loan adviceContact me for expert loan adviceHit the button below to arrange a conversation with one of my loan specialists to find a deal that's best for your situation. Book a review today We partner with over 50 lenders so you can find the perfect solutionFollow Facebook Linkedin Do you have questions about mortgages or loans?Ask us in the comments below … [Read more...] about Why your student loan can make it harder to get a home loan

Price gap between houses and units hits record level

Buying a typical house will now cost you almost 30% more than buying the typical unit.CoreLogic has reported that, at the end of February, Australia's median house price was 29.8% higher than its median unit price – a record gap. To put it in dollar terms, median prices are $791,400 for houses and $609,800 for units, which means the gap is almost $182,000.That gap has significantly widened in the past two years:February 2020 gap = 8.3% / $43,000February 2021 gap = 16.2% / $87,000It’s possible the house-unit price gap will further widen, because now that so many Australians are working from home, more people want a dedicated home office, which could lead to increased demand for houses.On the other hand, it’s also possible the gap will narrow, because with houses looking relatively dear and units relatively cheap, demand might shift from the former to the latter.Get in touch if you need a home loanGet in touch if you need a home loan Hit the button below to arrange a conversation with one of my loan specialists to find a deal that's best for your situation. Book a review today We partner with over 50 lenders so you can find the perfect solutionFollow Facebook Linkedin Do you have questions about mortgages or loans?Ask us in the comments below … [Read more...] about Price gap between houses and units hits record level

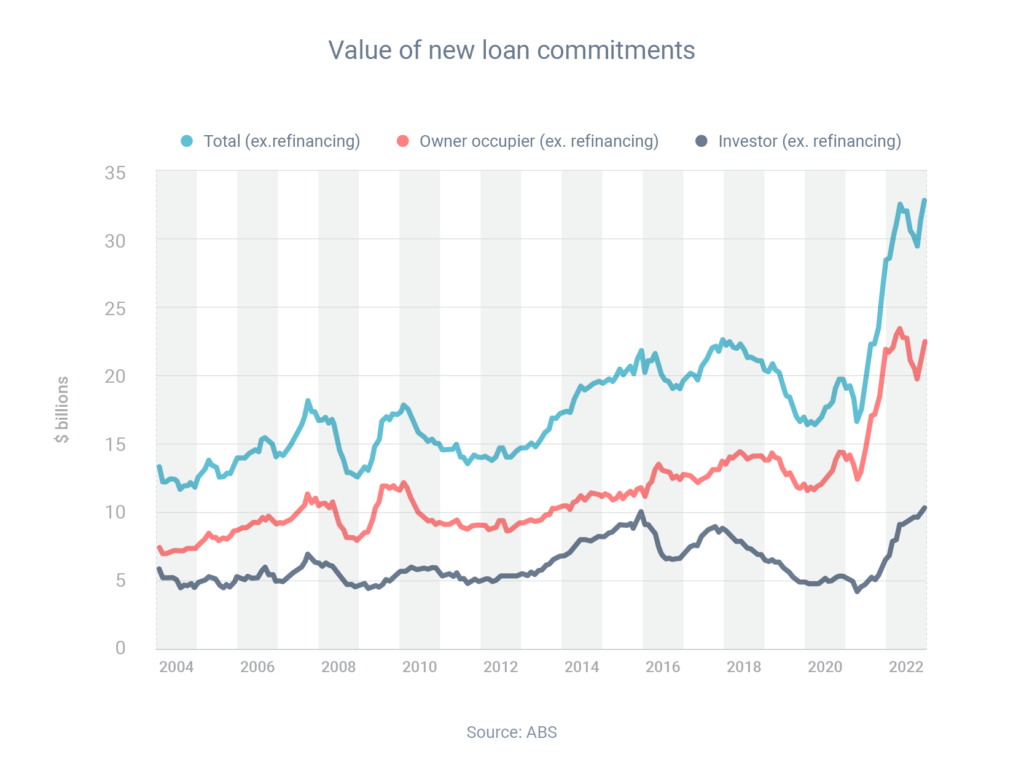

Property investor activity grows 67.8% year-on-year

The official data confirms what you might’ve heard anecdotally – property investors are very active right now.Property investors took out $33.7 billion of home loans in January, according to the Australian Bureau of Statistics, marking the second consecutive month in which investors set a borrowing record. To illustrate how investment activity has surged in recent times, investors borrowed 67.8% more in January than the year before.This increase has occurred throughout the country, with investment activity increasing by:Queensland = up 94% over the year to JanuarySouth Australia = 81%Victoria = 67%New South Wales = 64%Western Australia = 56%ACT = 42%Northern Territory = 33%Tasmania = 32%Australia’s vacancy rate (the share of untenanted rental properties) is at an incredibly low 1.1%, according to the latest data from Domain.That means most property investors are finding it easy to secure quality tenants. It also gives many investors the chance to raise rents, because demand for rental accommodation is so high right now.I can help you buy an investment property Hit the button below to arrange a conversation with one of my loan specialists to find a deal that's best for your situation. Book a review today We partner with over 50 lenders so you can find the perfect solutionFollow Facebook Linkedin Do you have questions about mortgages or loans?Ask us in the comments below … [Read more...] about Property investor activity grows 67.8% year-on-year

A Step-by-Step Guide to Buying a House: Advice from an Experienced Mortgage Broker

Buying a house is a thrilling event, but it's also a hard and time-consuming procedure. So, to help the house-buying process go more easily, follow our step-by-step guide and obtain your ideal home with expert assistance from Freshwater Financial Service's experienced mortgage brokers!Step One: Consultation with a Mortgage BrokerThere are loads of different home loans available in Australia today, all with its own set of benefits, drawbacks, and advantages; this is why working with a mortgage broker is so important during the home-buying process. A mortgage broker will assess your goals and provide a home loan that meets your financial and lifestyle requirements.A mortgage broker may also help you organize your finances so you can figure out how much you can spend and how much you'll need to save for a down payment. Your mortgage broker can also explain if you qualify for any additional benefits, such as the first-time home buyer's grant.Because everyone's circumstances are unique, the amount of money you can borrow is determined by the following factors:Earnings,Financial responsibilities,Savings,Step Two: Find the Lowest Mortgage RatesFollowing that, a mortgage broker will assess hundreds of house loans to find the best one for you, taking into account your borrowing capacity and estimated repayments.The interest rate is critical when it comes to getting a good deal on a home loan. Because a home loan is such a lifetime process, even little interest rate differences may quickly add up. Even a 0.5 percent interest rate reduction, for example, can save you hundreds of dollars over time.Your mortgage broker will assist you in preparing for the house loan application procedure if you are satisfied with the mortgage broker's home loan selection and interest rate.Step Three: Obtain Pre-Approval for a Home PurchaseWhile a pre-approval is not required as part of a home loan application, your mortgage broker should advise you to get one since it increases your chances of being accepted.A pre-approval is a letter from a lender indicating that you are eligible to apply for a loan up to a certain amount. To get a pre-approval, simply provide your mortgage broker your credit history and other required paperwork, and he or she will examine your income and give you very clear limits on how much you may loan. You can think rationally about your house search if you have pre-approved funding.Step Four: Locate a Home to PurchaseWhen looking for a home, it's critical to strike a balance between the lifestyle you want and your budget.Most mortgage brokers advise their clients to prepare a list of the following items:Property size, design, public transportation, and schools are must-haves' that you can't live without.Design, fittings, and outside space are examples of 'nice-to-haves' that you might live without for the time being.Step Five: Inspection of Structures and PestsHire an expert to check the building once you've chosen one you like. They'll point out any … [Read more...] about A Step-by-Step Guide to Buying a House: Advice from an Experienced Mortgage Broker

What you can do today to prepare for possible rate rises

The Reserve Bank has said it will increase the cash rate at some point. When that happens, banks will almost certainly raise their mortgage rates. So what can you do to prepare?Here are five tips:Calculate by how much your repayments would increase if your home loan rose by anywhere from 0.25 percentage points to 1.50 percentage points in the years aheadGet ahead on your mortgage now, so less of your loan needs to be repaid if and when those rate rises occurIncrease your saving rate, so you’re covered if your monthly repayments increaseContact your lender today to ask for a rate cut – if you threaten to switch to another lender, there’s a good chance your lender will agree to your requestThink about refinancing from a variable-rate loan to a fixed-rate loan Give me a call if you want to discuss how a rate rise might affect your individual situation.Need home loan advice? Get in touch. Hit the button below to arrange a conversation with one of my loan specialists to find a deal that's best for your situation. Book a review today We partner with over 50 lenders so you can find the perfect solutionFollow Facebook Linkedin Do you have questions about mortgages or loans?Ask us in the comments below … [Read more...] about What you can do today to prepare for possible rate rises

BUYING A HOUSE VS APARTMENT:

Share on facebook Share on twitter Share on linkedin So you've chosen to buy a house, but you're undecided between a condo and a single-family house. Only you can select what you're looking for in the end. If You are a first home buyer in Sydney you'll need to figure out what your goals are and what kind of lifestyle you want to live. Pros and Cons of buying a home: Houses provide additional room, remodelling possibilities, and privacy. However, if you have a garden or buy an older home, you'll be responsible for extra property care Pros: There is plenty of room on the floor. Houses give significantly more room to roam than flats if you want to conquer the ultimate frontier and provide more space for your family to live comfortably outside area. A backyard is beneficial if you have a green thumb, plan to extend your home, or have small children. You may construct a pergola or an entertainment area and take advantage of the flexibility that comes with having your own outside space. You can pretty much do anything you want if you own property since there are no owners' corporation or strata restrictions to follow. You're very much free to refurbish any way you want as long as you follow municipal and construction requirements. You may add value to your home by expanding or upgrading it, increasing your equity, and making it more livable. Another advantage of living in a house rather than an apartment is that you are usually not as close to your neighbors. As a result, you may enjoy your life without worrying about disturbing your neighbors (or being disturbed by them). On average, house prices rise faster than apartment prices. Cons: Prices are going up. Houses are always more expensive than comparable flats in the same neighborhood. This means you have two options: save a larger deposit and borrow more, or buy a property in a less expensive neighborhood. It's time to mow the lawns, clear the gutters, trim the trees, and clean the windows. Building a house necessitates a significant amount of labor. That's fine if you enjoy gardening and DIY tasks. If you don't, the low-maintenance component of apartment living may appeal to you. Costs are rising (and more bills). In general, renting a home is more expensive than renting an apartment. You'll need to heat and cool more areas, as well as purchase additional furniture and equipment. The Pros and Cons of Purchasing an Apartment : Although having a unit or apartment necessitates less maintenance, it also comes at a higher cost. Your neighbors are only a few walls, floors, or ceilings away. Pros: There is less upkeep. When you live in an apartment, you don't have to mow the grass or care for the garden. There's also the fact that strata can take care of a lot of maintenance jobs, leaving you with more free time to do anything you choose. The price is low. Apartments have less room, which might be a disadvantage, but it also means lower power and gas expenses. Location. Many … [Read more...] about BUYING A HOUSE VS APARTMENT: