Are you thinking about buying a second house? Owning a second home can be exciting, but it's important to do your research first. In this blog post, we'll cover 10 important things to consider before buying a second house. From understanding your financial situation to choosing the right location, these tips will help you make an informed decision about purchasing a second home.Whether you're looking for a vacation getaway, an investment property, or a future retirement home, it's crucial to plan ahead and avoid common pitfalls. So, let's dive in and explore the key factors to keep in mind when buying a second house. Why Buy A Second House Buying your second house can be a smart choice for many reasons. First, it can serve as a vacation home. Having a place to escape to during holidays or weekends can provide a much-needed break from daily life. Imagine having a cosy cabin in the mountains or a beach house by the ocean. This can be a great way to create lasting memories with family and friends.Another reason for buying your second house is investment. Real estate can be a good way to grow your money over time. If you buy a house in a good location, its value may increase. You can rent it out when you are not using it, which can help cover the costs of the mortgage. This means that buying your second house can also help you earn extra income.Finally, a second house can give you more space. If your family is growing or you need a home office, having an extra house can solve these problems. It can be a place for guests to stay or a quiet spot to work. Buying your second house can help you enjoy life more fully and meet your changing needs. #1 - Figure Out If Buying A Second House Is A Worthwhile Investment Buying a second house can be a big decision. First, you need to think about the costs involved. This includes the price of the house, taxes, and insurance. You should also consider the money needed for repairs and maintenance. If you plan to rent it out, think about the costs of finding and keeping good tenants. Make sure you have a clear budget to see if you can afford these extra expenses.Next, think about where you want to buy your second house. The location is very important. A house in a good area can grow in value over time. Look for places that have good schools, parks, and shops. You can also check if the area is popular with renters if you plan to rent it out. Researching the local market can help you understand if buying your second house is a smart choice.Finally, think about your goals for buying your second house. Are you looking for a vacation home, a rental property, or a place to retire? Each choice has different benefits. If you want to rent it out, think about how much money you can make. If it’s a vacation home, consider how often you will use it. Understanding your goals can help you decide if this investment is right for you. #2 - Know Your Goals And Motivations For Buying A … [Read more...] about 10 Things You Should Do Before Buying A Second House

How to avoid loyalty scheme tricks

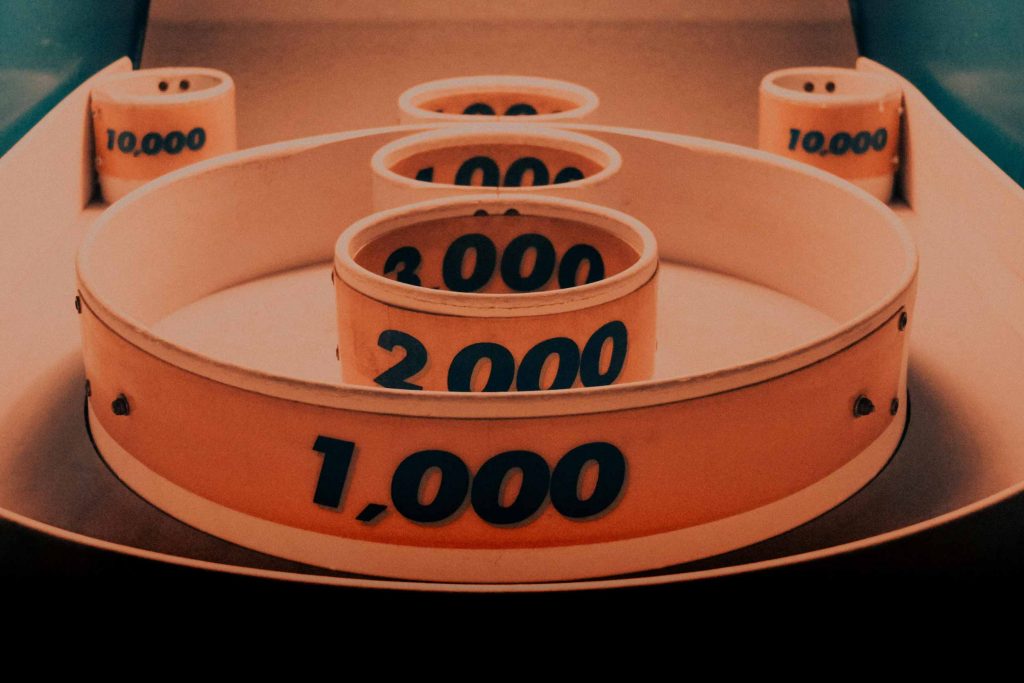

Feel like you’ve been getting a raw deal from customer loyalty schemes? Well, Australia’s competition watchdog says you might be right.The ACCC has released a new report into loyalty schemes, such as frequent flyer, supermarket and hotel operators. The report calls for loyalty operators to:· Provide more information to consumers· Improve their data practices· Stop automatically linking people’s payment cards to their loyalty scheme profilesThe ACCC wants loyalty operators to more prominently alert people when their points are about to expire and to stop collecting data on the sly.The ACCC also wants the government to ban unfair contract terms in loyalty schemes and to introduce a new law against certain unfair trading practices.Five tips for consumersCompanies use loyalty schemes to collect your data and send you targeted adsDon’t make unnecessary purchases just to earn pointsJust because you get a points discount at one business, it doesn’t mean you can’t find the same product for less at another businessKeep track of when your points are due to expireLoyalty scheme conditions change from time to time, so read your emailsLooking to buy a property? Hit the button below to arrange a conversation with one of my loan specialists to find a deal that's best for your situation. Book a review today We partner with over 50 lenders so you can find the perfect solutionFollow Facebook Linkedin Do you have questions about mortgages or loans?Ask us in the comments below … [Read more...] about How to avoid loyalty scheme tricks

Why you should avoid Afterpay

Share on facebook Share on twitter Share on linkedin Buy-now-and-pay-later business, Afterpay is definitely shaking up the payment marketplace. There’s even a nightclub that’s proposing to offer it to it’s customers. Even still, it’s a highly debated issue among Australians. My advice about Afterpay? And if you’re thinking about purchasing, investing or refinancing a property in early 2020, don’t use Afterpay for your holiday shopping. More generally, if you’re going to use it, do it after you’ve got your home loan. Banks and lenders that see Afterpay on your banking statements get nervous about your saving and spending habits. More simply, it raises flags about a consumer's ability to budget and live within their means. I’m working with many customers who have very strong loan applications but are running into issues because of just a few small Afterpay transactions. If you’re going to use Afterpay, use it as a short term incentive but make sure to pay it back as quickly as possible. If you need a hand managing your existing Afterpay payments, or would like to know more about how these could impact your home loan application, I'm happy to speak with you. Let's get real about Afterpay Hit the button below to arrange a conversation with one of my debt management specialists to lower the affect on your home loan application. Chat about my debt We experts in debt consolidation. You're in good hands. Follow Facebook Linkedin Do you have questions about mortgages or loans? Ask us in the comments below … [Read more...] about Why you should avoid Afterpay